After a strong performance in the stock market, Apple's valuation reached another record, after its shares went up to an all-time high at the close of NASDAQ trading.

With the boost, the Cupertino-based company has its market capitalization to surpass $1.5 trillion. This makes it the first U.S. company to ever reach that mark.

Market capitalization is the share price multiplied by the number of outstanding shares of the company's stock, yielding the company's overall stock market value.

At a price of around $352 per share and with roughly 4.3 billion shares outstanding, Apple's market capitalization exceeds far beyond $1 trillion.

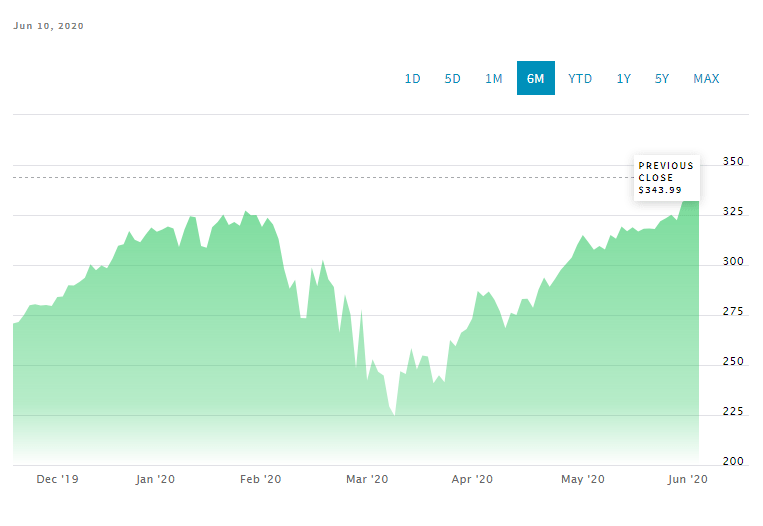

Apple’s valuation in the stock market has experienced ups and downs. And the most dramatic was when two major investor panicked in the past two years: one at the turn of 2018 and 2019, when reports suggested iPhone sales were declining, and another when the 'COVID-19' coronavirus first swept China, where much of Apple’s critical operations and partners are located, earlier this 2020.

Apple has worked hard to address the problems, and generally, investors have been happy with the progress they've seen.

Related: Apple Becomes A $1 Trillion Company

Some of reasons were caused by Apple in launching more services and produce content that could at least partially make up for the smartphone slowdown, which also affects its competitors.

This was followed by the company's announcement about its upcoming shift to ARM-based Macs.

Swapping over to its own house-made chips, Apple should be able to release updates on its own schedule and with possible more frequent technology improvements. Apple should also be able to differentiate its devices from others in the competition with chips designed by its own internal teams.

What's more, Apple should also be able to introduce even tighter integration between its hardware and software.

Another reason of investors' optimism include anticipation of the launch of a 5G iPhone this 2020, signs of strong App Store sales, and interest in the longterm potential of Apple's explorations in health and augmented reality (AR) technology.

With those, its stock price surged, even as investors began pulling back in many other areas of the economy.

It should be noted that Apple has been initiating an aggressive campaign to buy back some of its own shares to reduce its cash reserves, which many investors deemed to be excessive.

This helped Apple increased the value its remaining shares on the market. That decrease in share count is, however, accounted for in market capitalization calculations.

What this means, Apple's total share count was declining. As a matter of fact, Apple's share price fell 35% from its peak by late March.

But the strong and steady recovery brought Apple back up to a fresh all-time high.

Apple managed to divert attentions from supplier constraints, store closures, and ongoing curbs on travel and transport, to how it can increase demand for new devices, that was buoyed by the increasing numbers of people working from home.

With those reasons, Apple managed to counter most of the market's speculation, and again showed that it is still one of the most valuable company in the world.

Read: The Wuhan Coronavirus Affected Apple's Supply Chain, Sales And Revenue