In was back in 2017 when Bitcoin reached nearly $20,000, an astonishing price for an 8-year-old currency at the time. But then, things go south.

Price for the popular digital coin went down to as low as $3,000 in just a few months. This worried investors, and things were rather quiet. But in 2020, Bitcoin again showed its volatility when its price climbed north to $30,000 and beyond.

That move was followed by a surge in smaller cryptocurrencies such as Ether, which passed the $1,000 mark for the first time since February 2018.

"There's no denying that bitcoin has proven itself as an established and top-performing asset," said Eric Demuth, CEO of digital asset broker Bitpanda.

"Bitcoin's value grew over 300% last year as more institutional investors took that leap to embrace digital currencies."

"We're seeing it emerge as a part of the recommended allocation strategy for institutional investors and investment banks."

Throughout 2020, institutions have been increasingly accumulating Bitcoin, which has become compelling because of its fixed supply.

Adding to that, the concerns about inflation and rising central bank liquidity have intensified. This trend has led high-profile institutional investors to consider Bitcoin as a potential hedge against inflation.

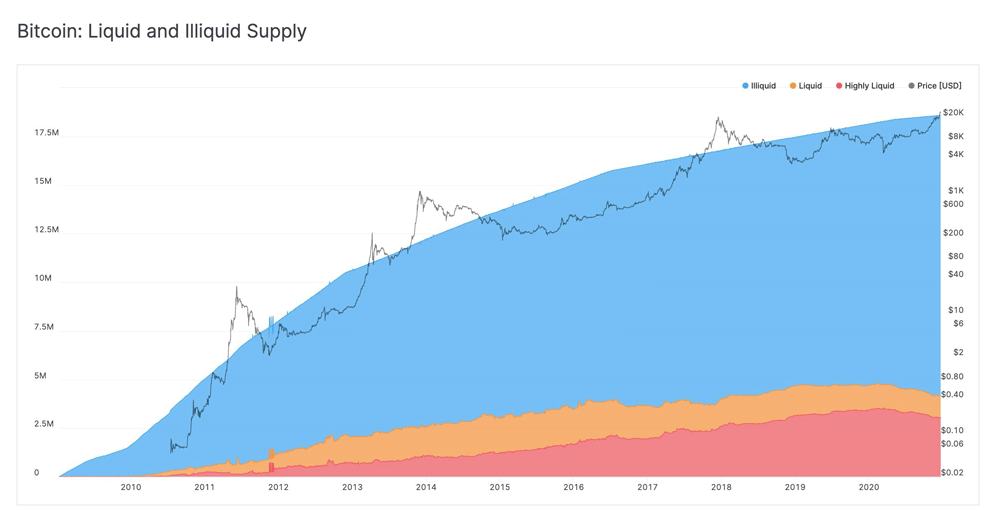

As more people buy Bitcoins, its liquidity is declining.

This happens because the amount of Bitcoins received and spent among entities is decreasing, making Bitcoin more difficult to buy.

In turn, this could make Bitcoin in circulation even more scarce, and again capable of increasing its price.

However, as Bitcoin's price climbed quickly, more people are becoming short-term profit takers, rather than long-term investors. Given by the sentiment and appetite for Bitcoin that experienced the sudden spike, it seems likely that any correction will be short lived.

It's during this sudden surge that more and more people put interest in cryptocurrency. Many started to believe that Bitcoin can be the source of investment, and wealth.

Bitcoin at this time has been around for only a little over a decade, after it was created by Satoshi Nakamoto in 2009. But it only began to rise in popularity among mainstream institutional investors in 2019.

Bitcoin's price resurgence was in part fueled by well-known Wall Street billionaires publicly backing the cryptocurrency. Large financial companies like PayPal and Fidelity have also made moves in the cryptocurrency while the likes of Square and MicroStrategy have used their own balance sheets to buy Bitcoin.

Prominent figures that weren't into cryptocurrencies, have also started to show their interest.

This is why cryptocurrency bulls have said that Bitcoin is seen as a hedge against inflation, similar to gold, especially in the face of unprecedented government stimulus aimed at tackling the coronavirus pandemic..

But still, there are skeptics.

Despite seeing the decentralized digital currency as an independent entity from any central authority, such as a central bank, those people see Bitcoin as a speculative asset with no intrinsic value and a market bubble that is likely to burst at some point.

Read: Big As Whale, Small As Plankton: Explaining The Cryptocurrency World That Has Animals As Names