Cryptocurrencies are known for their volatile nature.

At any given moment, prices can soar high, and in an instant, things can go south as prices plummet. One of the known ways to make a cryptocurrency more stable, is by tying its price to be pegged to another cryptocurrency, fiat money, or to exchange-traded commodities, like gold or other precious metals.

The advantage of having the so-called 'stablecoin' is that, as an asset-backed cryptocurrency, its price is stabilized by assets that fluctuate outside of the cryptocurrency space. This makes its underlying asset not correlated, and this reduces financial risk.

Because stablecoins are not supposed to fluctuate in value like other cryptocurrencies, traders often use stablecoins to buy and sell other riskier assets.

Terra is a blockchain that runs the Luna cryptocurrency, created in 2018 by Terraform Lab.

Luna that is considered a stablecoin, is associated with the Terra protocol, using a proof-of-stake design. Terra leverages fiat pegged stabled coins to power a payment system.

In May 2022, horror happened that made Terra wiped out almost $45 billion in market capitalization within a week.

What happened here was that, Terra is tied to fiat.

The cryptocurrency is named according to the currencies to which it is pegged. For example, TerraUSD (UST) is pegged to the U.S. dollar. And Luna here, serves as the primary backing asset for Terra, and is also used as a governance token for users to vote on Terra community proposals.

Things were looking good, and UST was even touted as "the first decentralized stablecoin that is scalable, yield bearing and interchain."

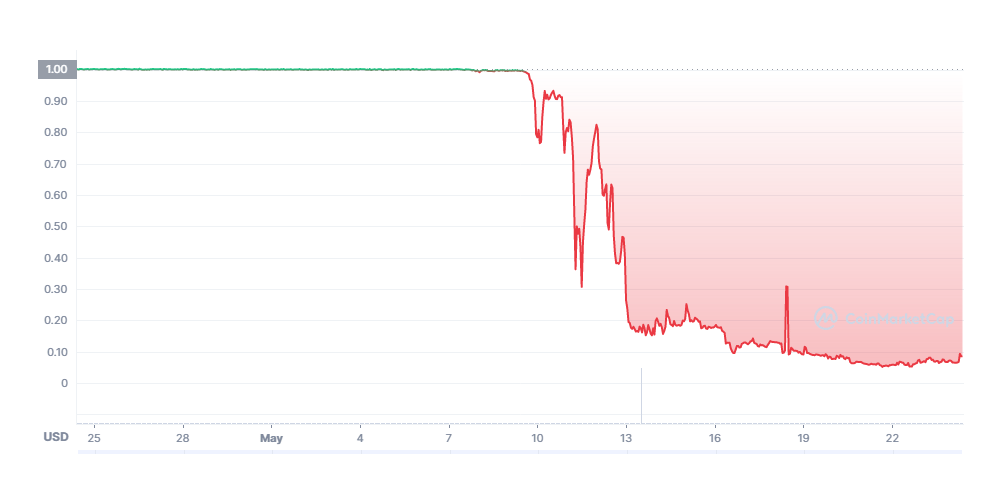

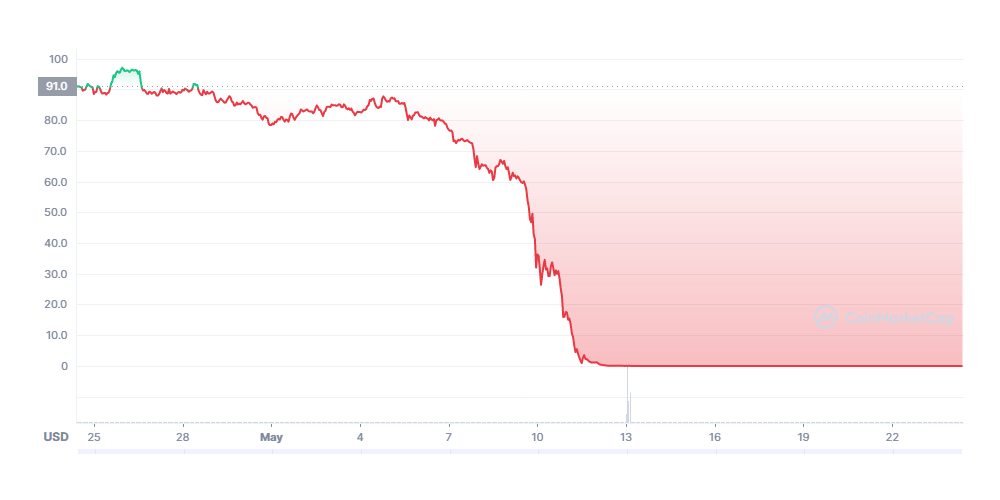

But starting May 9th, things started to go bad.

Over the next week, the price of UST plunged to "virtually zero." Or to be exact, around 10 cents, down from an all-time high of $119.51.

This happened shortly after UST stablecoins severed its peg with U.S. dollars, and started to maintain its peg through a complex model called a "burn and mint equilibrium".

This method uses a two-token system, whereby one token is supposed to remain stable (UST) while the other token (LUNA) is meant to absorb volatility.

This is designed to make the coin benefit from a high-yielding mechanism, while at the same time, more stable.

However, the move made many Terra holders to convert to Luna via the mint-and-burn system, and this caused Luna to collapse due to its increased supply. And also because Bitcoin price also dropped due to Russian invasion to Ukraine among other reasons, UST was destabilized.

Responding to the situation, Terraform Labs temporarily halted the Terra blockchain, and started attempting to stabilize both UST and Luna, through Bitcoin.

Do acquired some Bitcoins by selling $1 billion Lunas to investors, and Terraform Labs use the proceeds to stockpile Bitcoins, in order to create a reserve to keep the price of UST stable if the markets ever dipped.

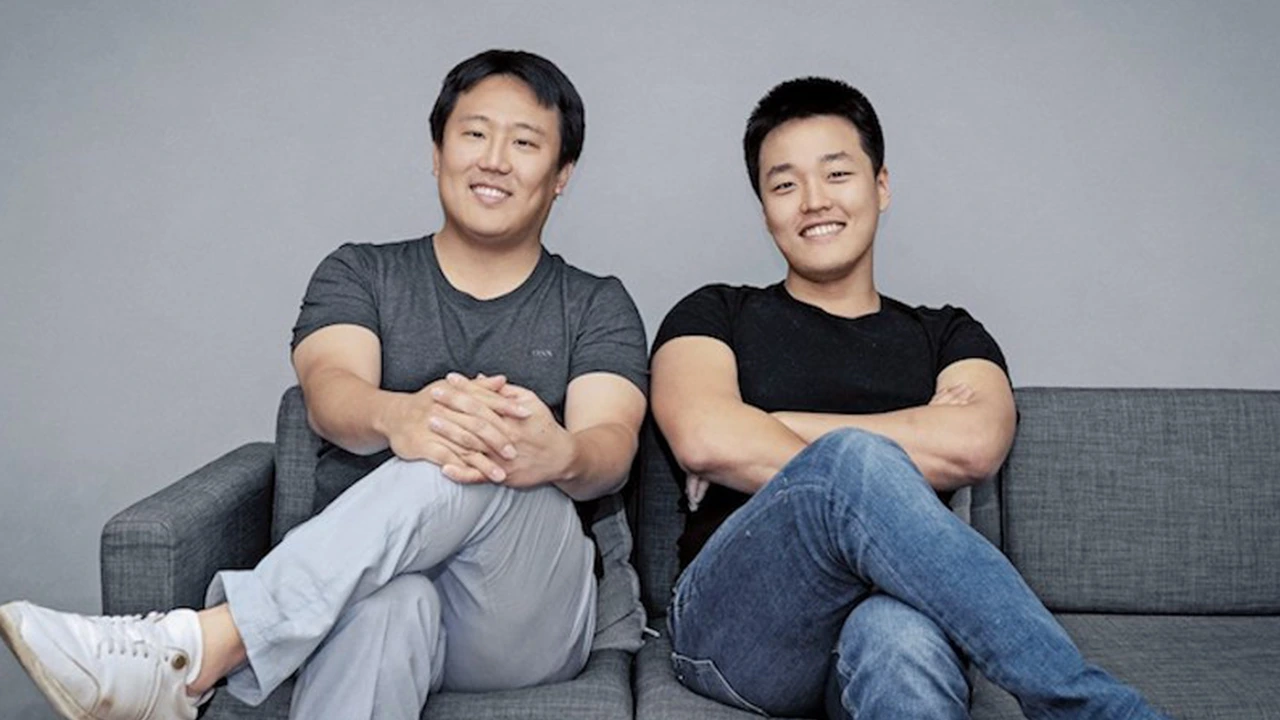

Terraform Labs was founded in South Korea by Do Kwon and Daniel Shin (also known as Shin Hyun-sung).

Do managed to gain investors and supports, and called the cryptocurrency he created in 2018 as “my greatest invention.”

With more than $200 million from investors, Do managed to fulfill his promises, and ballooned Luna's total valuation to more than $40 billion.

Due to its high valuation, both Luna and UST had enough momentum to even affect the price of Bitcoin.

Some of Terraform Labs made significant profits, that were about 100 times their initial investment.

But because of an unpredicted downfall, the price of the cryptocurrency plummeted. Despite being a stablecoin, Luna and UST were dragged, and also dragging down Bitcoin, which lost around $300 billion in value.

The fall of Luna and USET was criticized by many, with people saying that it was caused by Do's irresponsible behavior.

2/ I still believe that decentralized economies deserve decentralized money – but it is clear that $UST in its current form will not be that money.

— Do Kwon (@stablekwon) May 13, 2022

Luna was extremely profitable through its 1:1 U.S. dollar peg. Without it, and only powered by algorithms, things didn't sort out well.

Many have lost their life savings because of the fall, and because of this, both Do and his fellow Terraform Labs co-founder Daniel Shin are facing a lawsuit.

Kim Hyeon-kwon, an attorney at the law firm, submitted the complaint to the Seoul Southern District Prosecutors’ Office, alleging fraud and fundraising without approval.

Regardless, some cryptocurrency experts predicted this.

Many were skeptical that an algorithm would keep Do’s twin cryptocurrencies stable. What's more, even Do once alluded to the possibility of a cryptocurrency collapse, by publicly joking that some cryptocurrency ventures might ultimately go under.

The entrepreneur known for his trash talks, said that he found it "entertaining" to watch companies crumble.

And when the prices of the two cryptocurrencies really plummeted, Do has nothing to say.

"I am heartbroken about the pain my invention has brought on all of you," he tweeted.

The collapse of UST and its associated cryptocurrency token Luna, has called the $180 billion stablecoin market into question.

Following the fall, Do and the community want to rebuild what's left.

Do proposed a "Terra Ecosystem Revival Plan," where he wants to restart the entire Terra blockchain, with network ownership getting distributed entirely to UST and Luna holders through 1 billion new tokens.

12/ The Terra community is my family.

I will always be here, no matter how hard it gets.

Let's build it back up again - together.— Do Kwon (@stablekwon) May 16, 2022