Blockchain technology is believed to be the solution to many of modern days' problems.

First conceptualized by the mysterious Satoshi Nakamoto in 2008, blockchain is decentralized and transparent, and should make information transaction relatively more secured and better.

However, there are challenges of using this blockchain technology, and one of which is scalability.

Bitcoins for example, is one famous crytocurrency that uses blockchain. By design, Bitcoin uses a process called Proof-of-Work. While this is a great way to validate transaction, it's actually kind of slow and cumbersome.

As Bitcoin has grown in popularity, the slowness of this verification process has become the focus of debates about how Bitcoin's blockchain should be “scaled” to increase its throughput.

There are numerous solutions, and one of them is by using 'sidechains'.

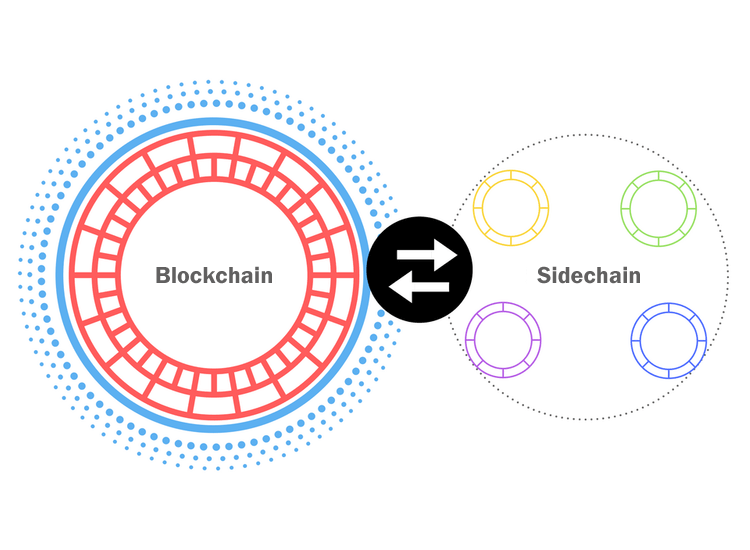

Like how the name suggests, sidechain is a type of blockchain, but exists beside its master chain (parent chain). This is why sidechains can also be referred to as child chains.

Think of the master chain as a highway where vehicles can travel very fast, and sidechains as a series of roads built adjacent to the highway, in which cars and enter or exit the highway whenever necessary.

Technically speaking, sidechains are like the supplements of their master chains, with them being linked to the main blockchain via two-way pegs, which allows assets to be interchanged between the parent blockchain and the sidechain.

This enables it to hold significant potential for the enrichment of the capabilities of existing blockchains.

Simply put, sidechains are just the "layers" put on top of the Bitcoin protocol.

The term “sidechain” was first described in the paper titled “Enabling Blockchain Innovations with Pegged Sidechains”, by Adam Back et al in 2014.

How sidechains can help is by allowing their parent chains to offload their work to them. Running in parallel to their parents, the child chain has enough resources to do some chores, letting the parent chain to make way for more work to be done.

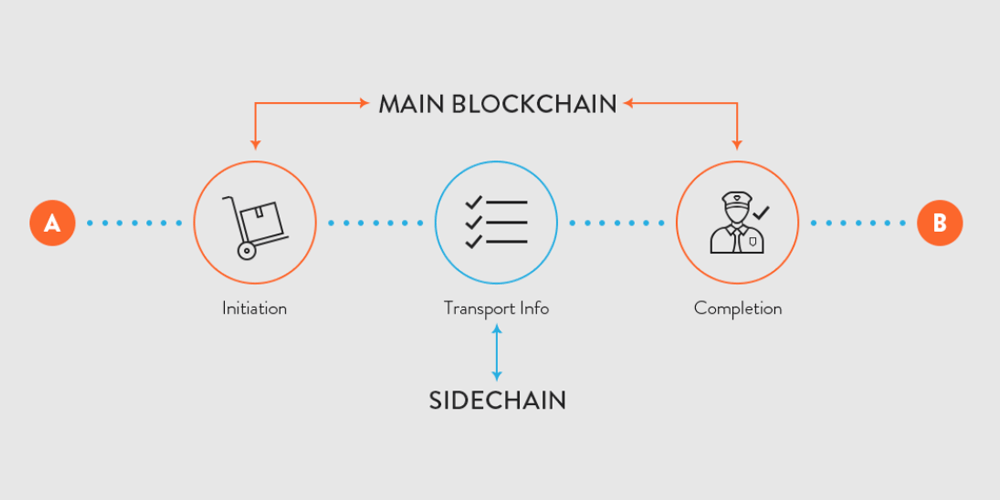

To make sidechains function properly, they need to have digital assets or tokens.

Usually these come from a user on the parent chain. As assets that move between parent and sidechains are pegged bothways, the coins are transferred between the chains at a pre-agreed rate.

To get the coins on the sidechain, users can send the coins to a predetermined address connected with the sidechain. This address will hold on to the coins, which effectively make them 'locked" - preventing the user from spending them on the parent chain or anywhere else.

Once the locked funds from the parent chain have been communicated across all chains, they will become available on the sidechain. The user will then be able to pick up their coins and start using them on the sidechain.

When moving cryptocurrency from the sidechain back to the parent chain, this process is effectively reversed: it is released back to the parents once its been proven that the sidechain is no longer using it.

Sidechains leverage blockchain's interoperability that can connect different blockchains together.

The good things about these sidechains is that, they are actually independent from their parent chain. They are also permanent, which means developers don't have to create a new sidechain every time they need to use one. Once a sidechain is built, it is maintained and can be used by anyone doing a specified task off the main chain.

Sidechains can also take care of their own security. Here, problems that occur on the sidechain can be controlled without affecting the main chain. Likewise, a security problem on the main chain should not affect the sidechain, although the value of the peg is greatly reduced.

Because sidechains allow cryptocurrencies to interact with one another, they practically add the flexibility.

Added benefits of sidechains are asset classes like stocks, bonds etc. can be integrated through a converted price onto the main chain, alongside the additional functionality like smart contracts, unique D-Apps, security updates and so forth.

They can all be later incorporated into the primary network from these sidechains.

This benefits developers as they can experiment with beta releases of Altcoins or software updates before pushing them on to the main parent chain.

Traditional banking functions, for example, can test tracking ownership of shares on the sidechains before moving them onto main chains.

The main disadvantages of sidechains is the need for miners, in which they can be given incentives through merged mining. These miners are required to ensure the safety of these sidechains. This makes the formation of new sidechains a costly venture.

Another downside to sidechains is the need of a federation. The extra layer formed by the federation could be a weak point for attackers.

If costs can be lowered and security mechanisms can be bolstered, sidechain technology holds promise for massive blockchain scalability.

Further reading:

How Blockchain Technology Can Change The Way Modern Businesses Work

How Blockchain Can Disrupt Online Marketing, Including The Web Itself