Zoom is the popular video-conferencing app that got its big boost during 'COVID-19' coronavirus pandemic where more people are working and studying from home.

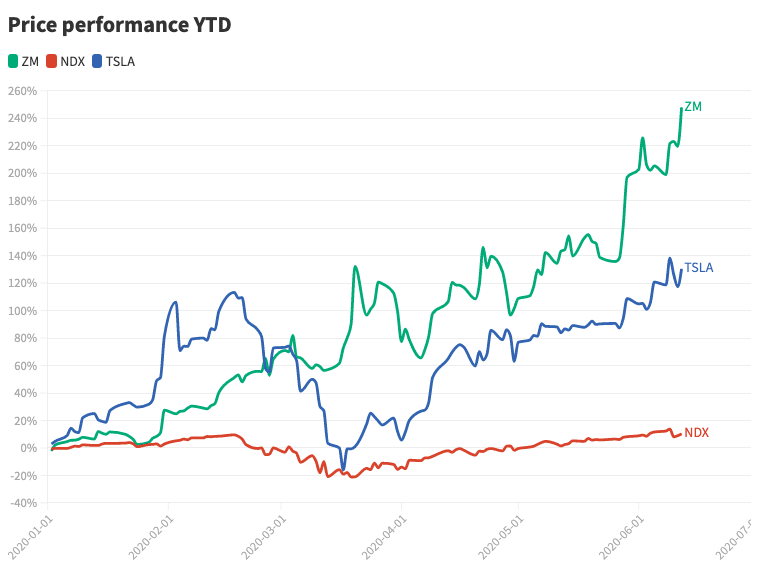

In 2020 alone, the company’s stock is up 250% (from $68.72 to $239.02), and has returned 45% in the past month alone. Zoom‘s revenues have also skyrocketed, driven by a growing base of enterprise users. Last quarter, the company generated $328.2 million, or up by 169% year-on-year.

The end result, is Zoom‘s market cap to swell and hit $67.43 billion.

This means that Zoom's market is worth more than General Electric's ($63.33 billion).

It is even valued beyond the likes of Advanced Micro Devices or AMD ($64 billion), bigger than Regeneron Pharmaceuticals ($66.4 billion); Unilever ($64 billion); General Electric ($63.33 billion); CME Group ($62.6 billion); and Colgate-Palmolive ($62.4 billion).

With its shares keep on going up, Zoom could surpass Wall Street’s Goldman Sachs, and mining giants BHP and Rio Tinto.

Zoom's popularity was clearly boosted by the pandemic. But even before the crisis, the videoconferencing dynamo was no slouch either.

In 2019 for example, before the crisis, the company posted adjusted profit per share of $0.35, showing that its business was growing fast before actually making a profit shortly before the crisis.

And amid the coronavirus pandemic, only a few stocks have been as successful as Zoom.

During the crisis, Zoom has gone from a niche business tool to an essential service, underpinning online social gatherings, business meetings, classes, and everything that happens in between. The brand itself has even become synonymous with videoconferencing itself.

Zoom is not the only one in the business.

Facebook, Google, Microsoft and some others have their own similar offerings. But Zoom here is still the clear winner. Zoom is already the best known pure-play videoconferencing stock, and not just a product by some company that does many things.

Among this and other reasons, including users' positive reviews of the product, Zoom's status as an essential tech tool during a time of social distancing has made it one of the biggest coronavirus winners on the stock market.

Despite Zoom in having a clear prospect in the foreseeable future, industry analysts aren’t exactly sure how to value Zoom moving forward.

In April for example, a Credit Suisse analyst effectively advised clients to start selling their Zoom shares.

What's more, Zoom has its own share of controversies.

From multiple privacy and security issues, to the one that surrounded the company's interactions with China.

But still, Zoom for people around the world, still managed to serve as the technological backbone for much of the world’s transition into remote work and education during the coronavirus pandemic.

Related: Tesla Becomes The Most Valuable Car Company In The World