A month after Apple became the first publicly-traded trillion-dollar company in U.S. history, Amazon quickly raced and also surged past the one trillion dollars mark.

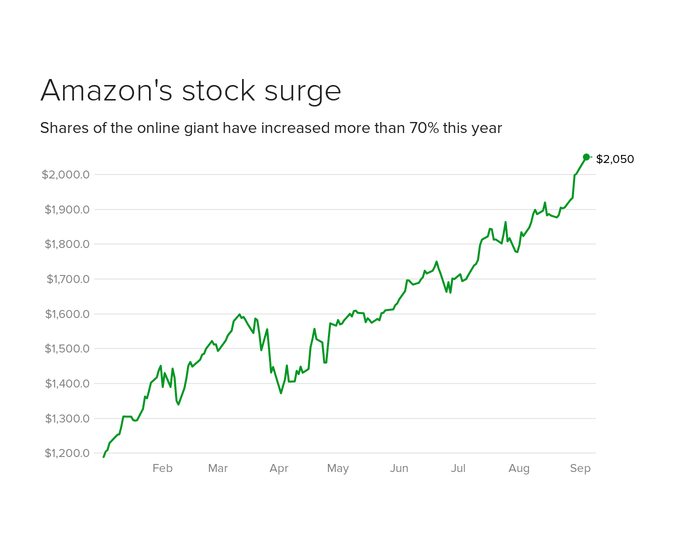

The internet retail giant became the second public company in the U.S. history to hit the milestone when its shares rose by around 2 percent, briefly topping $2,050 which made it past that valuation for the first time.

The stock, which ended the day up 1.3 percent, has surged nearly 75 percent in 2018, and added about $430 billion to the company’s market capitalization.

Going by the numbers, Amazon captures 49 cents of every e-commerce dollar in the U.S.. More than 550,000 people work for the company, as it generates $178 billion in annual revenue.

Amazon had a humble founding when it was an offline bookstore in Jeff Bezos’s garage in 1993.

At that time, the internet was very young, fragile and was just starting to become a viable platform. And when amazon.com went online in 1995, there was nothing stopping the company in growing.

As the company reached numerous milestones, so did Bezos.

In 2017, Bezos reached a net worth of $100 billion. And a brief moment before Amazon reached 1 trillion valuation, Bezos who owns roughly 16 percent of Amazon, as of an August regulatory filing, is worth about $165 billion, according to the Bloomberg Billionaires Index.

This is about $70 billion more than the second richest man, Bill Gates.

Amazon and Apple, which have both passed the trillion-dollar milestone, symbolize the growing influence of tech companies on markets and the economy.

While there are a lot of other companies in different but profitable industries, like oil, and also industrial giants that have been around for more than a century, like Boeing (market cap $207 billion), 3M ($119 billion) and General Motors ($55 billion), they are worth far less than the tech companies because their prospects for earnings growth are nowhere near as strong.

Tech-related companies boom because they have, collect, save, preserve and process data. Information has become a new currency, the base of growth to whoever possesses it.

High gain with unlimited possibilities, is the main thing that sells. To investors, customers and media, this translates to excitement.

The companies’ increasing grip in the society has prompted lawmakers to scrutinize the tech sector more closely.

In the meantime, Facebook, Alphabet's Google and Microsoft are all racing to also pass the one-trillion-dollar milestone.