Cybersecurity company McAfee Corp. is going private.

The company confirmed a transaction for it to be sold to a consortium of private equity firms for $26.00 per share in an all-cash transaction valued at approximately $12 billion on an equity value basis, and over $14 billion on an enterprise value basis after giving effect to repayment of McAfee debt.

The purchase price represents a premium of approximately 23% over McAfee’s closing share price of $21.21 on November 4, 2021, the last trading day prior to media reports regarding a potential sale of McAfee.

The investor group is led by Advent International, Permira Advisers, Crosspoint Capital, Canada Pension Plan Investment Board, GIC Private, and a unit of the Abu Dhabi Investment Authority agreed to purchase McAfee, a statement said.

Collectively, the Investor Group shall provide McAfee with both financial and operational resources to further enhance its business and offerings. The Investor Group shall support McAfee as the company continues to broaden its differentiated online protection solutions and drive long-term value through market expansion.

Upon completion of the transaction, McAfee common stock will no longer be listed on any public securities exchange.

According to McAfee President and Chief Executive Officer, Peter Leav:

“We want to thank our employees for their continued hard work and commitment to McAfee. We are thrilled to be partnering with premier firms who truly understand the cybersecurity landscape and have a proven track record of success.”

McAfee is a company with complicated history, moving between public and private, and at one point even changing its name.

The company was founded by U.S. technology entrepreneur John McAfee in 1987, originally as an antivirus software developer for personal computers.

It was considered the first to bring to market a commercial antivirus.

McAfee eventually went public before being purchased by Intel for $7.7 billion in 2010, and went private again.

At that time, McAfee freed himself from any involvement with the company he founded.

It was in 2014, that the company changed its name to Intel Security, before Intel sold 51% of its stake to TPG in 2017 for $4.2 billion. That deal valued McAfee at $4.2 billion including debt.

The company then changed its name back to McAfee.

Since its split from Intel, McAfee has pivoted to cloud services and worked to build out its platform with a focus on its enterprise product portfolio.

In 2020, McAfee returned to the public and raised $740 million on a $9.5 billion valuation.

At that time, it was partly-owned by private-equity firms TPG and Thoma Bravo LP and Singapore sovereign-wealth fund GIC Pte. Ltd.

And through this deal that is expected to close sometime in the second half of 2022, McAfee is becoming one of the largest cybersecurity acquisition in tech history.

By becoming a private company, McAfee shall continue building and developing cybersecurity solutions to protect users against computer viruses, malware and other online threats to more than 180 countries across more than 600 million devices.

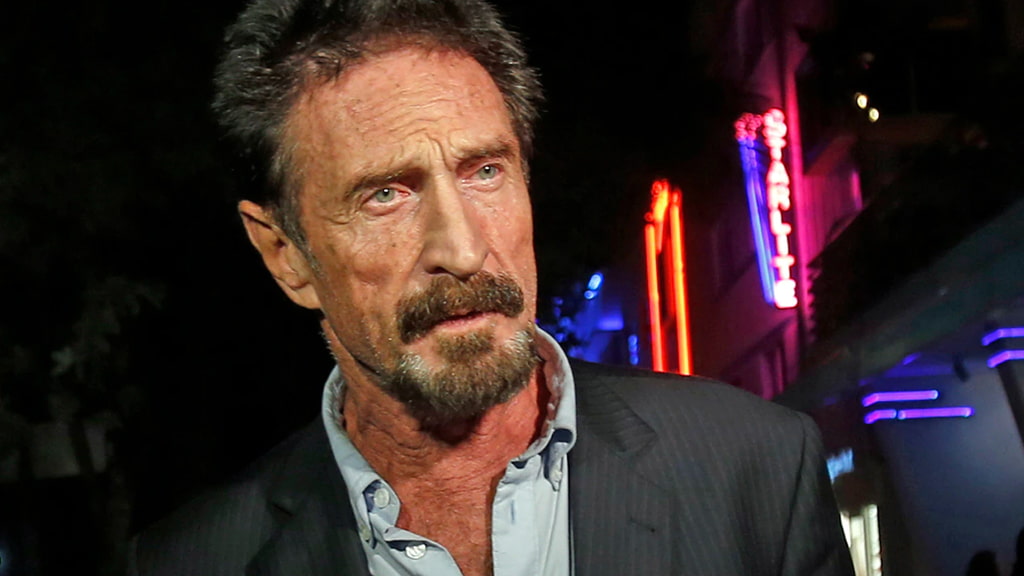

As for John McAfee, he was also no stranger to controversies and complex history.

After disappearing and fleeing, he was arrested in connection with the suspected murder of his neighbor.

John McAfee died in a jail in Spain earlier this 2021. At that time, he was going to be reported to the U.S. in connection with federal tax-evasion charges.

Business in the tech industry is booming, as more and more people use technology on a daily basis.

And cybersecurity is no exception.

Security has been particularly demanding as more people work remotely and several high-profile breaches affecting both consumers and businesses underscored its importance.

And this deal here comes as the COVID-19, pandemic-driven shift to remote working and a rise in cyber attacks have spurred demand for antivirus and digital security software.

While McAfee may not be in its prime days anymore, McAfee has evolved fast, and strengthened its main cybersecurity software business that focuses on retail via price increases, new partner programs and good retention rates.

In a similar deal, seeking to create a leader in consumer security software, U.S.-based NortonLifeLock was acquired by London-listed rival Avast for up to $8.6 billion.

Read: Avast And NortonLifeLock Merge To Become A Much Larger Cybersecurity Company