Yahoo! has had a harsh time, and now it is time for the company well-known to be the dot-com survivor older than Google or Facebook, to redeem itself. The communication giant Verizon has agreed to acquire Yahoo! for an all-cash deal.

The price for all that isn't cheap. Verizon has to pay $4.83 billion, and that doesn't include Yahoo!'s shares in the Chinese e-commerce and tech titan Alibaba, its shares in Yahoo! Japan nor a small portfolio of patents.

Being acquired by Verizon, and after all the transaction is closed, Yahoo! may continue to operate as it was under its assets under a publicly traded investment with a new name.

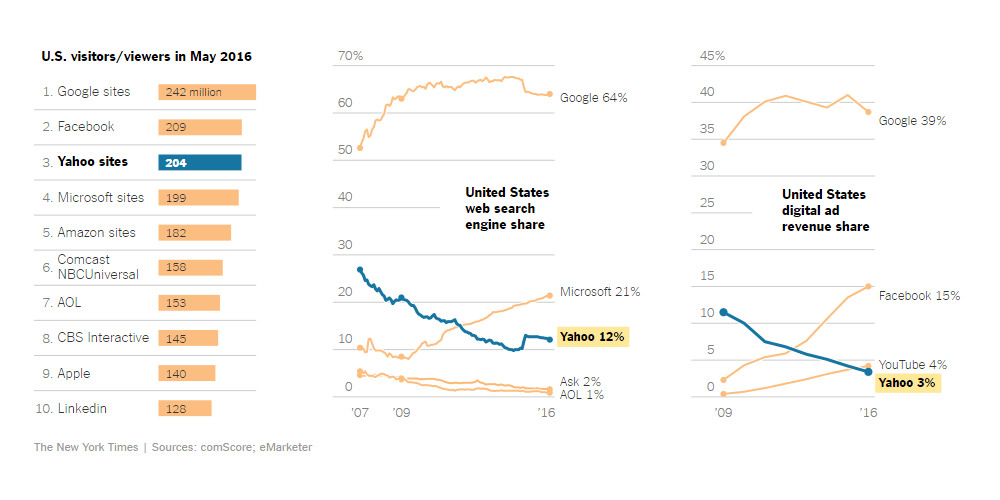

Yahoo! was founded in 1994. The brainchild by Jerry Yang and David Filo was the front door to the web for the early generation of internet users. To them, Yahoo! was the first thing that came up to their mind when first accessing their browser to look for something on the web. But the titan as fall under the feet of younger but more powerful competitor, mainly Google and Facebook who are now controlling most of the internet's advertising.

Those two younger behemoths have figured out the way to survive the internet is to relentlessly process reinvention in order to stay ahead of the next big thing.

Yahoo! at its peak, has flirted with buying the two company at their infancies. In 2001, Yahoo! could have bought Google for $3 billion. In 2006, Facebook was offered $1 billion. But yet, it failed to compete with the two in the next coming years. At $4.83 billion as of 2016, Yahoo! is just a fraction of Google that is reportedly worth $498 billion and Facebook at $350 billion.

This is essentially the result of the internet that is now an unforgiving place for yesterday's great idea.

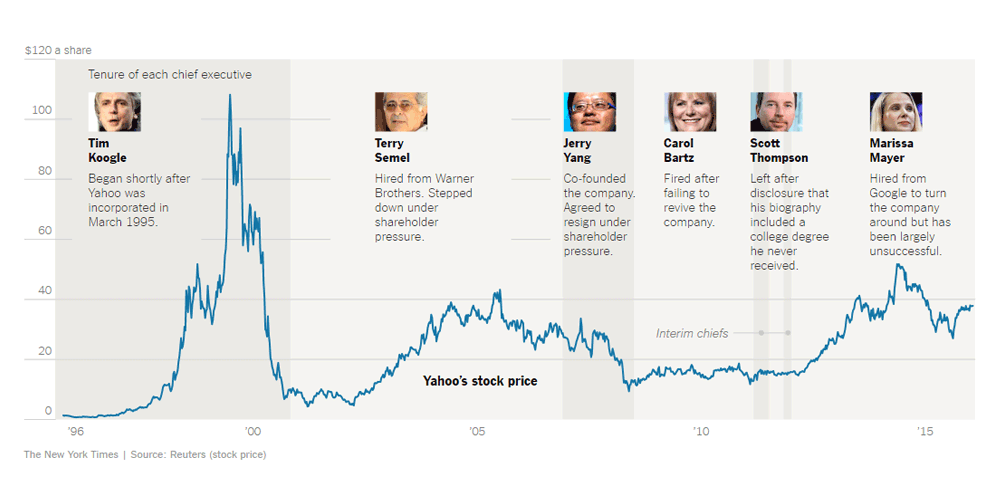

Its numerous attempts to get back in track had been troublesome and didn't give much of a difference. Marissa Mayer, who took the helm at Yahoo! in 2012, has made little progress in returning the company to profit. She was credited for doing what she was supposed to do, including overturning the company's strategy, but still with little success.

Being acquired by Verizon, Yahoo! is now reaching the end of the line as an independent company it is known for.

Verizon in acquiring the falling Yahoo! is for a very good reason. Verizon which also owns AOL, is aiming to bring all of Yahoo! that include search, communications and digital content products, its ad services and others.

As an aged tech giant, its assets doesn't come cheap. Yahoo! has asked to sell itself for $10 billion with value lies in its users, more than any sites other than Google and Facebook. Users don't come cheap, and that is a bargain for Verizon that sees Yahoo!'s potential which has a global audience of over 1 billion users (600 million monthly active users).

With Verizon, Yahoo! and AOL which is seen as the two of the biggest players of the early internet age, will come together under one flag.

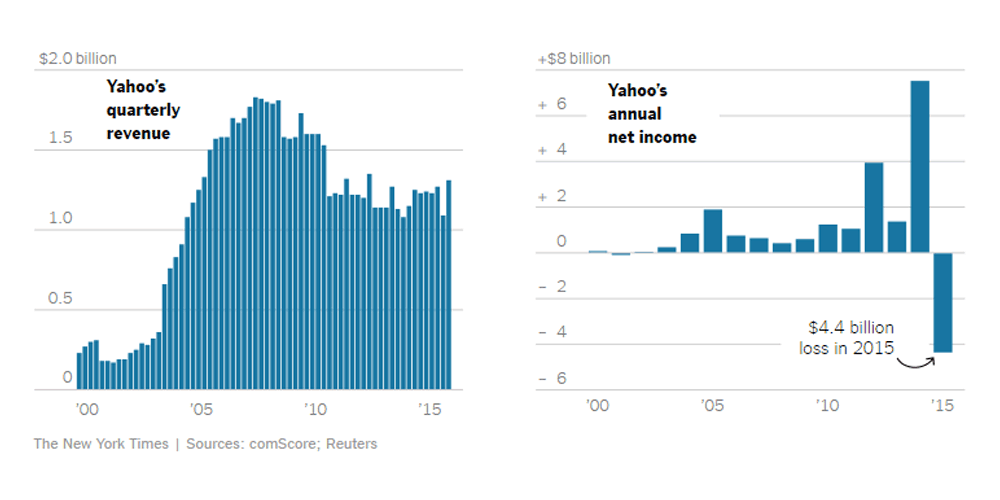

The fall of Yahoo! is an example of the biggest downfall in the history of internet business. In January 2000, Yahoo! was at its peak with a value of over $125 billion. The fall of the company has made its value plummet to even come below than what Microsoft has offered to acquire it back in 2008 ($45 billion).

But $4.83 billion is still larger if compared to analysts' calculation on December 2015, which valued Yahoo! at about $3.9 billion.

The acquisition however, doesn't involve one or two parties. Being acquired by Verizon, Yahoo! has to deal with numerous propositions. One of which was Marissa Mayer's acquisition during her reign as CEO, and whether to make her stay on her capacity, or not.

"Yahoo is a company that has changed the world, and will continue to do so through this combination with Verizon and AOL," said Mayer. And in an email to her staff, Mayer said that she is planning to stay, adding that: "I love Yahoo!, and I believe in all of you. It's important to me to see Yahoo! into its next chapter."

Mayer was credited as the CEO that put rebound Yahoo!'s stock price to its highest levels since the dot-com crash. But since then, the company's value eroded again.

"We want to look forward not backward in terms of regrets."

But at the time when the news came, Mayer is not expected to join Verizon. She is due to receive a severance payout worth about $57 million, according to Equilar, a compensation research firm.

Another thing is to deal with Mozilla which is a non-profit organization behind the popular Firefox browser. Mozilla has a contract with Yahoo! which include a clause that enables it to get $1 billion if it doesn't like the company that purchases Yahoo!. And also not to mention Alibaba which felt Yahoo! was dragging its feet.

Verizon is optimistic about the acquisition. The telecommunication giant believes that Yahoo!'s core users can benefit its business by margins. And when it comes to Yahoo!'s various products, Verizon hopes that it can find a way to grow its advertising business with the many large brands it already has. Furthermore, Verizon is already having a wealth of data from smartphone users that it could mine.

Verizon acquired AOL was because the company has the programmatic advertising technology that allowed it to leverage its business. Yahoo! meanwhile, was struggling to build its mobile advertising business, which falls far from both Google and Facebook. By acquiring Yahoo!, Verizon is certain that with its high influence in the mobile sphere, Verizon can put Yahoo! back on its feet.

This was highlighted by AOL's chief executive Tim Armstrong when he said that the deal was about "unleashing Yahoo!'s full potential", and creating a major player in mobile media.

So its certain that as a start, Verizon will bolster Yahoo!'s mobile product. This is to extract Yahoo!'s capacity to the see whether there is anymore money that can be extracted from the 1990s internet heavyweight champion.

Together AOL and Yahoo will have more than 25 brands, including Yahoo Mail, Flickr and Tumblr as well as AOL's Huffington Post and Techcrunch news sites.

So should the acquisition means the end of an era for the web pioneer? Not necessarily true, at least until time will tell otherwise.