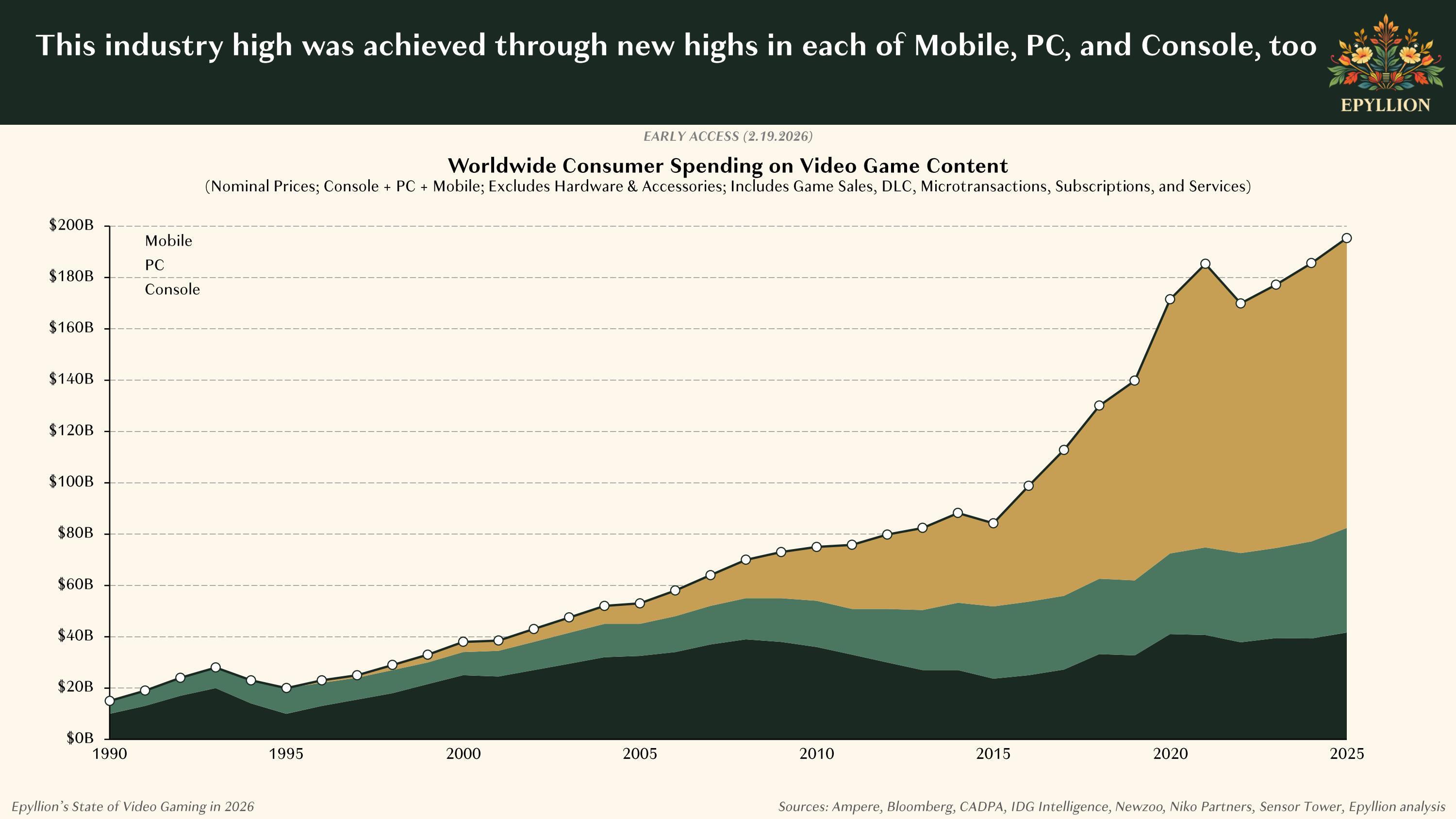

The video game industry, once seemingly unstoppable, spent more than a decade riding a wave of extraordinary growth.

Advances in graphics and computing power pushed games closer to cinematic realism, while online connectivity transformed solitary play into massive social ecosystems. Blockbuster franchises became annual events, live-service titles promised endless engagement, and mobile gaming pulled billions of new players into the fold. Investors poured in capital, studios expanded at breakneck speed, and publishers operated under the assumption that player demand would only continue to rise.

Gaming was no longer just a pastime.

In fact, it had become one of the world’s most powerful entertainment industries, rivaling film and music combined.

Now, things are shifting.

According to a bombshell report from Epyllion, penned by analyst Matthew Ball, paints a grim picture: in the eight biggest markets (U.S., Japan, South Korea, UK, Germany, France, Canada, and Italy), which once drove over 60% of global gaming spend,the number of regular gamers is shrinking below pre-COVID-19 levels in half of them.

The U.S. has lost 2.5 to 4 percentage points of participation since before the pandemic, with 46 out of every 100 Americans now playing less, and mobile installs hitting a 12-year low.

Canada shed one in six adult players from 2018 to 2022, South Korea plummeted 15 points from its 2017-2019 average, and the UK has watched a third of its pandemic gains evaporate.

It's not just players vanishing, because spending on PC and console software in these mature markets has cratered 8% since the pandemic peak, a $4.2 billion annual hit, with the U.S. alone down $2.3 billion.

Sure, total video game spend is up $12.9 billion since 2019, but that's dwarfed by the explosion elsewhere.

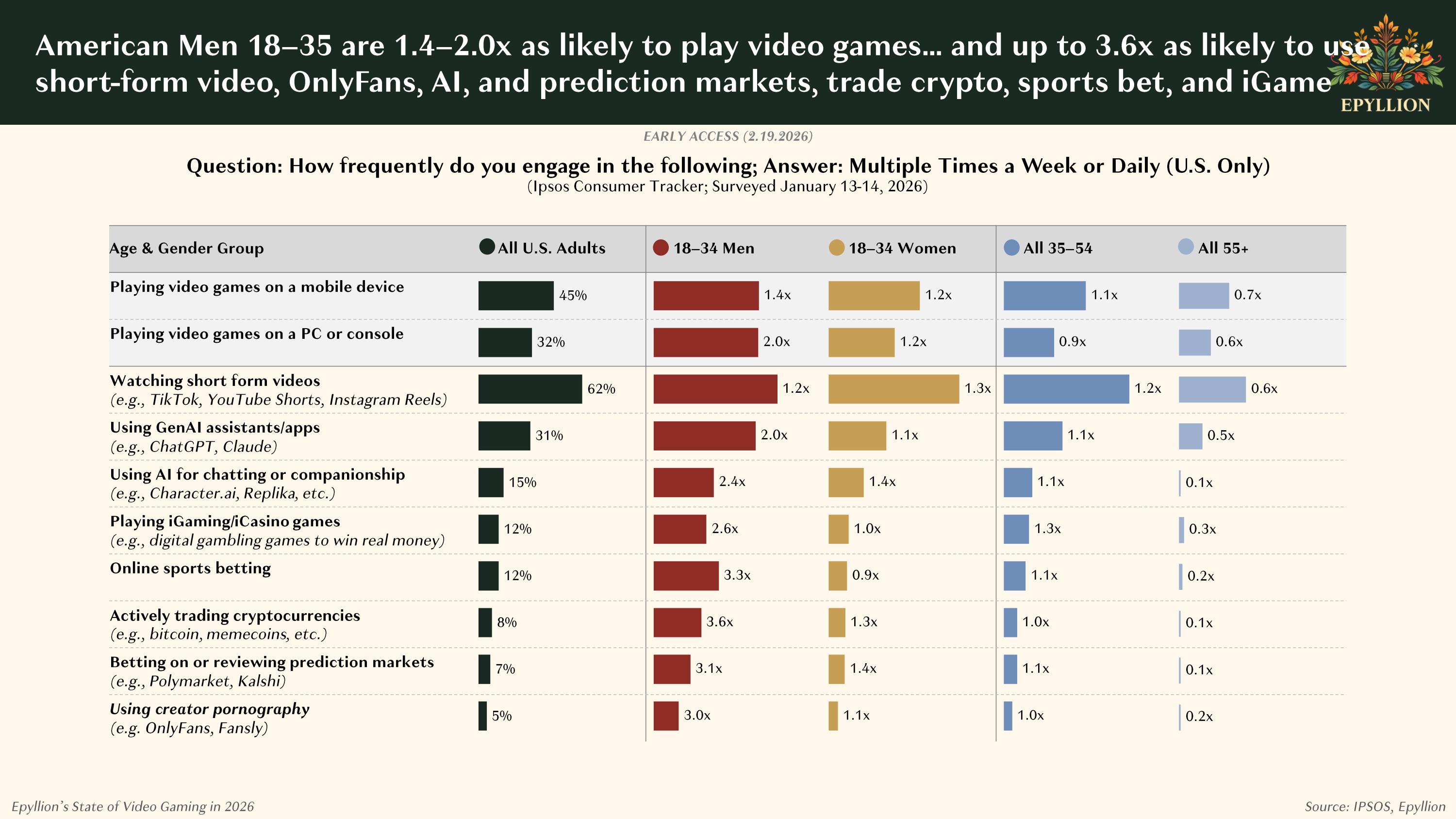

Most notably, the global gaming industry is failing to compete for attention against OnlyFans, online sports betting, and iCasinos surged from $1.2 billion to $32.8 billion in the U.S. over the same stretch.

OnlyFans alone hit $5 billion in US spending by 2025, up from a measly $215 million in 2019. This is a 23-fold leap fueled by creator porn that keeps users glued with endless, personalized depravity.

Sports betting losses? $17.6 billion in the US last year, quadrupling since 2019, while global iGaming devours $54 billion annually. This is nearly half of worldwide gaming revenue.

View the full “The State of Gaming in 2025” report by Matthew Ball (Epyllion) above via Issuu.

As for the time spent, where did it all go?

Short answer, they all go straight to the dopamine slot machines of TikTok, AI chatbots, crypto memecoins, and prediction markets. U.S. TikTok watch hours exploded by 39 million daily since pre-COVID-19, part of a 122 million hour surge in social media screen time.

AI apps for roleplay, erotica, and art racked up nearly a billion installs quarterly, while platforms like Polymarket and Kalshi hit 1.5 million bets a day by late 2025.

Ball nails it: "Video games not only compete with many new interactive substitutes, but video gamers face a barrage of new, interruptive, and irresistible notifications for these substitutes."

On a Friday night, that former Call of Duty grinder isn't queuing up—he's doomscrolling thirst traps, slamming parlays on DraftKings, or YOLOing into the next dog coin, his phone buzzing with fresh hits of instant gratification.

Young men aged 18-45, gaming's core demo, are ditching joysticks for higher thrills: they're 3.6 times more likely to trade crypto, 3.3 times to bet sports, 3 times to sub to OnlyFans, and 2 to 2.4 times to poke AI waifus than the average gamer. Live-service behemoths like Fortnite and Roblox hold steady, with Roblox snagged 67% of net growth.

For AAA titles are seeing the worse: they're flopping harder than ever, with even EA Sports FC 25 underperforming as attention fragments. Studios shutter, jobs vanish, and the survivors squeeze the loyalists with microtransactions, grindy battle passes, and ad-riddled mobiles just to stay afloat.

This isn't a blip; it's a structural shift.

Gaming's post-lockdown high was a mirage. At the time, participation peaked; everyone's happy. However, when the bitter truth started to unfold, the market nosedived as the world reopened and shinier vices beckoned.

China bucks the trend with raw population growth, but the West's mature markets are calcifying, forcing publishers to chase whales while the casual pool drains away.

Ball warns the real killer isn't choosing TikTok over God of War, or whether to subsribe to someone on OnlyFans and play some blockbuster game. Instead, it's more about the slow bleed of evenings lost to gooning sessions, degenerate bets, and endless scrolls. The industry must evolve or die: lean into social hooks, AI integration, or risk becoming yesterday's relic in a feed dominated by porn, parlays, and pump-and-dumps.

The attention economy has spoken, and gaming is just late to the casino.