The global smartphone market consists of two markets.

The first is the premium market, which includes players like Apple's iPhones and some other high-spec Android phones. Phones in this category are considered the top-of-the-line phones, built as high-end devices to represent of a brand's flagship.

The second one is the budget market, which has long been dominated by Android phones of many sorts, followed by a minority of other devices.

Apple has been in the smartphone business since 2007, and its iPhones need no introduction.

The Apple device has been targeting the premium market right from the start, and this time, the brand is on the roll.

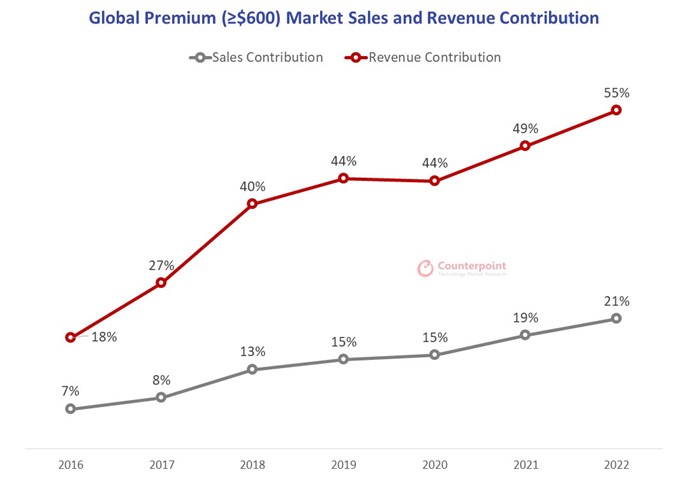

According to a report by a market research firm, revenue from iPhone and other devices that cost more than $600 grew to the point that they contributed more than half of all revenue from the product category in 2022.

In 2022, the global smartphone market faced macroeconomic difficulties led to a 12% year-on-year decline in overall sales.

However, there was an increasing number of consumers who used to buy budget smartphones, who are actually moving up to premium ones, reported Counterpoint Research.

While the global market for smartphones actually declined by 12% in 2022, compared to the previous year, but premium device sales grew 1% in that same period.

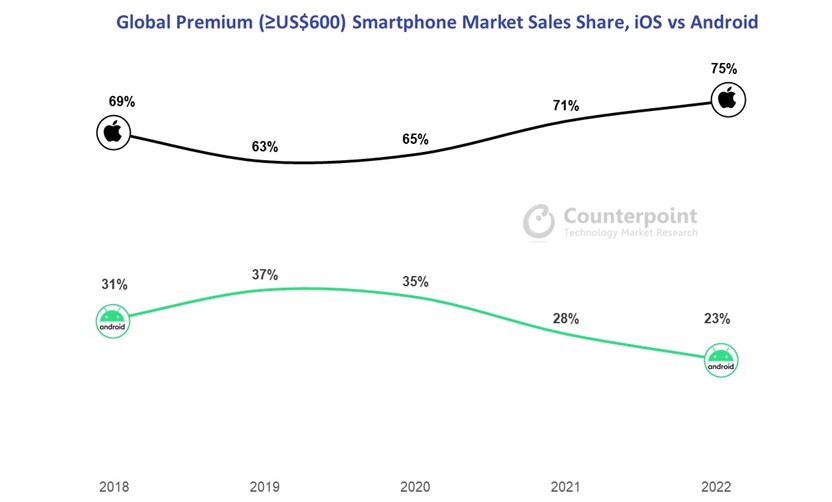

In particular, iPhone sales make up 75% of this category, whereas Android accounts for only 23% and dropping.

What this means, iPhones as premium devices, bring in more than half of global smartphone revenue.

"The premium segment, which has been consistently outperforming the global smartphone market, captured more than one-fifth of total global smartphone sales as well," explained Varun Mishra from Counterpoint Research.

And this happened globally, not just in the U.S. or Europe.

"As smartphones become more central to their lives, people are ready to spend more on their devices and retain them for a longer period," added Mishra. "This is also one of the reasons the $1,000 and above price segment was the fastest growing (38% YoY) in 2022."

The result was that revenue from top-tier models made up 55% of the global total, the first time it’s been over half the total.

Additionally, the premium segment captured more than one-fifth of total global smartphone sales.

According to the research, several factors contributed to the growth of the premium smartphone market in 2022.

One of the main factors was the resilience of affluent consumers, who were less affected by macroeconomic difficulties compared to other customers. As a result of this, sales in the premium market grew, while those in the entry and mid-tier segments declined. Furthermore, as smartphones become more central to people’s lives, they are willing to spend more on their devices and retain them for a longer period.

This is evident in the fact that the $1,000 and above price segment was the fastest growing, with a 38% year-on-year increase in sales.

Another main factors, was the “premiumization” trend.

What happened here is that, the demands of phones in the the premium segment was driven by people upgrading their last device.

In business, winners are picked based on who made the most money.

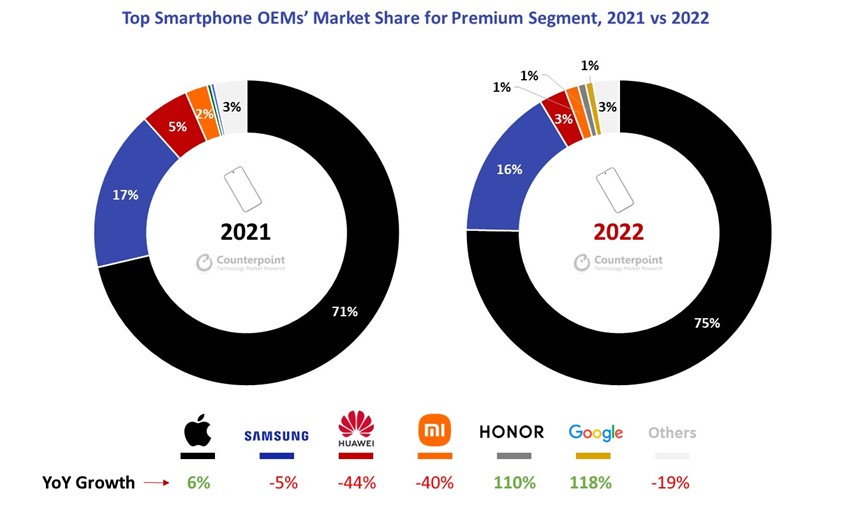

And because of the rising sales of premium devices, which is conquered by Apple, it's noted that Apple is bringing more total revenue if compared to its closest rival, Samsung.

Samsung, which is in second place in the premium market, experienced a decline in sales of about 5% year-on-year in 2022, according to Counterpoint Research.

Premium Androids phones, Samsung included, have never sold very well, according to Counterpoint Research, and with the increasing demand for premium phones from Apple, the Cupertino-based company is certainly having the lion’s share of the premium market. In terms of numbers of units sold.

However, despite Apple saw a healthy 6% year-on-year increase in sales in the premium market, and that it benefited from Huawei’s decline in China, the company could have grown more if not for the iPhone 14 Pro and Pro Max supply disruption during the peak holiday season in 2022.