Vice Media Group LLC, the American-Canadian digital media and broadcasting company, is one of the largest of its kind.

It comprises of Vice.com, which is its digital content department; Vice Studios, its film and TV production; Vice TV, or also known as Viceland; Vice News; and Virtue, which is an agency offering creative services. It's also the parent company for Refinery29 and Motherboard.

As large as it can be, Vice Media was once cited as the largest independent youth media company in the world.

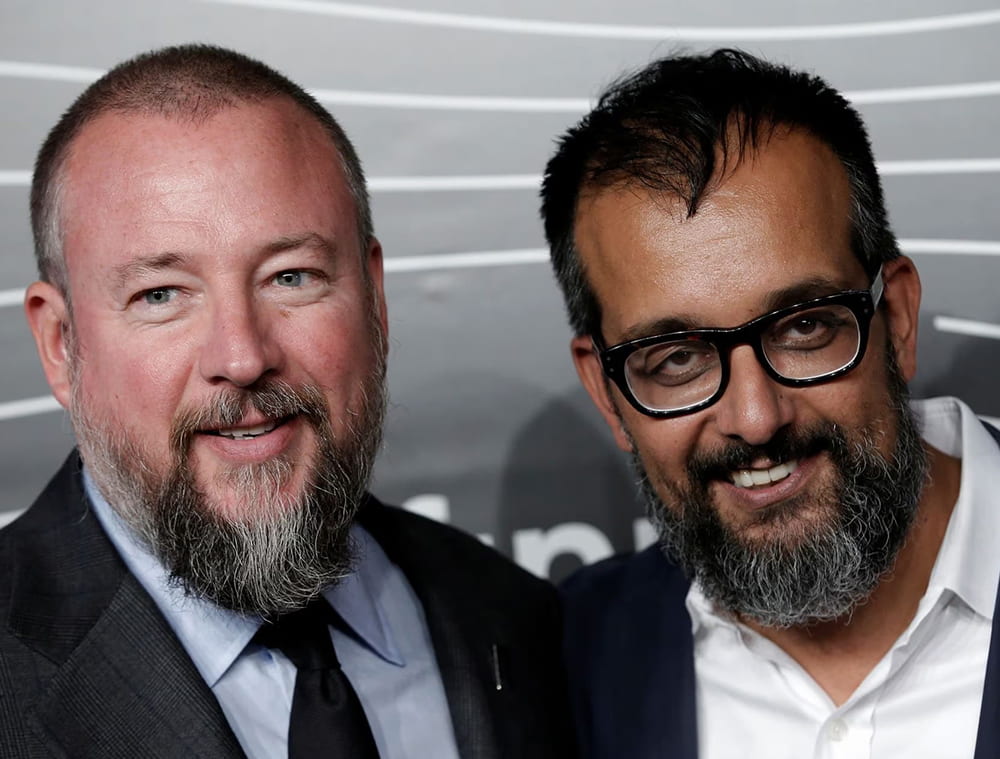

With 35 offices , it was originally founded by Shane Smith and Suroosh Alvi. Focusing on young to adult-focused digital media, Vice Media is not a stranger on the web and digital publication.

But just like any other business out there, it's not immune to issues.

In May 2023, it was reported Vice was preparing to file for bankruptcy. It later filed for Chapter 11 bankruptcy as part of a plan to sell itself to a consortium of companies.

It all began earlier in 2023, in January, when Vice Media reportedly began exploring the possibility of selling itself.

Then, on February, CEO Nancy Dubuc left, as the company faced problems, especially regarding issues dealing with turning an annual profit and finding a buyer. Then, in May, it was reported that Vince Media was preparing to file for bankruptcy.

At first, it was speculated that Vice's primary debt-holder, Fortress Investment Group, wanted to take control of a stake in Vice Media. And this news was followed by the fact that Vice Media formally filed for Chapter 11 bankruptcy, as part of a possible sale to a consortium of lenders including Fortress Investment Group.

In its Chapter 11 filing with the Southern District of New York (SDNY) federal court, Vice Media pegged the value of both its assets and liabilities between $500 million and $1 billion.

The filing also discloses that Fortress is Vice’s largest secured lender, with a total claim of nearly $475 million.

The group, alongside Soros Fund Management and Monroe Capital, would invest $225 million as a credit bid for nearly all of Vice Media's assets, along with its "significant liabilities."

As part of the deal, the lenders have agreed to lend an additional $20 million to allow the publisher to remain operational during the sales process.

Vice Media said that it has received commitments for debtor-in-possession financing from the lenders, as well the consent to use said amount cash, which it said will be "more than sufficient" to fund its business throughout the sale process.

It's worth noting that at its peak, Vice Media was once valued at $5.7 billion.

Vice Media was once looked at as a crown jewel in the fast-paced digital media sector as newspapers declined and investors looked for new types of content to lure viewers.

During its heyday, the company has received investments from various media powerhouses including A&E Networks, 21st Century Fox, and Disney, which invested a reported $400 million in 2015 at a valuation between $4 billion and $4.5 billion.

But since then, things go south pretty quickly.

In December 2022, the company was seeking a valuation of just $1.5 billion. But since it was missing its full-year revenue target by about $100 million, massive layoffs, and other things made downturn to contribute to its fall.

With these further complicating any potential sale, the best way for it to protect itself, is to file for bankruptcy.

This way, it can remain in control of its assets and business operations as a debtor in possession.

Vice Media's co-CEOs Bruce Dixon and Hozefa Lokhandwala said in a statement that the sale process will "strengthen the Company and position Vice for long-term growth."

"We will have new ownership, a simplified capital structure and the ability to operate without the legacy liabilities that have been burdening our business," they added.