Apple has long touted its various iPhone features as things that provide privacy and security to users.

The thing is, Apple is profiting in some of the features. While this is normal, Apple is not allowing anyone to have the same control. The company isn't allowing third-parties to have the same access, and prevent users from choosing some options.

Among the features that is strictly controlled by Apple, is the Apple Pay solution.

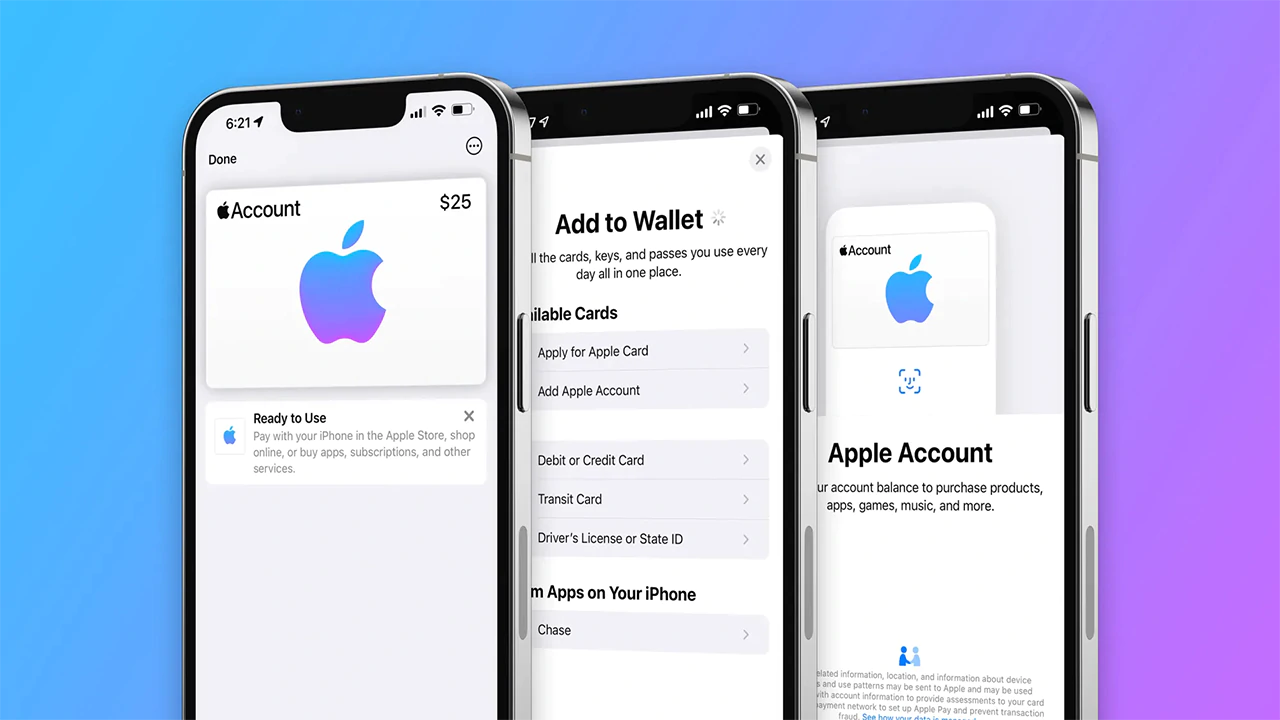

Apple Pay is a mobile payment service that allows users to make payments in person, in iOS apps, and through the web using Safari. It is supported on these Apple devices: iPhone, Apple Watch, iPad, and Mac. It digitizes and can replace a credit or debit card chip and PIN transaction at a contactless-capable point-of-sale terminal.

Because of Apple's utmost control over the feature, the company simply govern how users use their money, and profit from that activity.

This is why Apple is facing a lawsuit, with the company being accused of antitrust behavior.

The lawsuit claims the Cupertino-based company is too controlling over its Apple Pay platform.

According to the complaint, Apple makes over $1 billion a year by forcing more than 4,000 banks and credit unions that use Apple Pay to pay 0.15% fee per user transaction on credit cards and a 0.05% charge on debit cards. That figure is set to quadruple in 2023.

But yet, those same card issuers don’t have to pay for anything when their customers use "functionally identical Android wallets."

The suit alleges that Apple violates antitrust law by making it so Apple Pay is the only service able to carry out NFC payments on its iPhones, iPads, and Apple Watches. It also said that Apple prevents card issuers from passing on those fees to customers, which makes it so iPhone owners don’t have any incentive to go find a cheaper payment method.

In other words, Apple is blocking other tap-to-pay solutions, and force users to use Apple Pay without giving them viable options.

The suit is being kicked off by Iowa-based Affinity Credit Union, which issues debit and credit cards that are compatible with Apple Pay.

With the lawsuit, the company’s lawyers Hagens Berman in Seattle, California, want to make it a class-action case so other card issuers can join the lawsuit.

According to a press release from the law firm, the lawyers want to change the Apple policies that force all contactless payments to go through Apple Pay, and to make the company reimburse card issuers for the fees that the plaintiffs claims it illegally charged.

The Union believes that if Apple had competition in the its iPhone ecosystem for Apple Pay, the company would not be charging the fees that it does.

"If Apple faced competition, it could not sustain these substantial fees."

"Apple's conduct harms not only issuers, but also consumers and competition as a whole," the complaint said.

This kind of lawsuit isn't anything new for Apple.

The most notable case like this, was the Epic vs. Apple trial.

The plaintiffs said that Apple has a monopoly on "Tap and Pay iOS mobile wallets." But even if a judge agrees about that fact, they decided that Apple isn't monopolistic because users can always switch to Android if they want to, where other mobile wallets exist.