For the first time, Saudi Arabia's revealed details to investors that show how Aramco, its national oil company, is the world’s most profitable business.

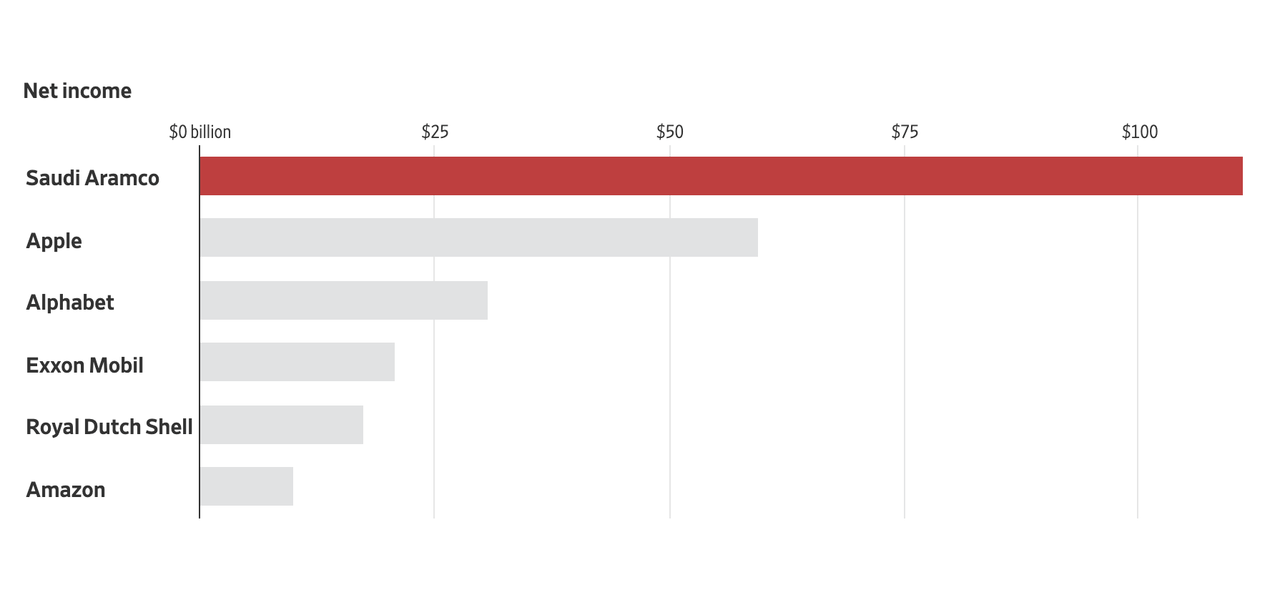

Aramco, or officially the Saudi Arabian Oil Company, is a Saudi national petroleum and natural gas company based in Dhahran, Saudi Arabia. On its report, the company made $111 billion in 2018. By comparison, Apple which frequently covered in the news as the post profitable company in the world, only made $59.53 billion in fiscal 2018.

What this means, Apple which hit the $1 trillion valuation in 2018, only earn roughly half of Aramco that year.

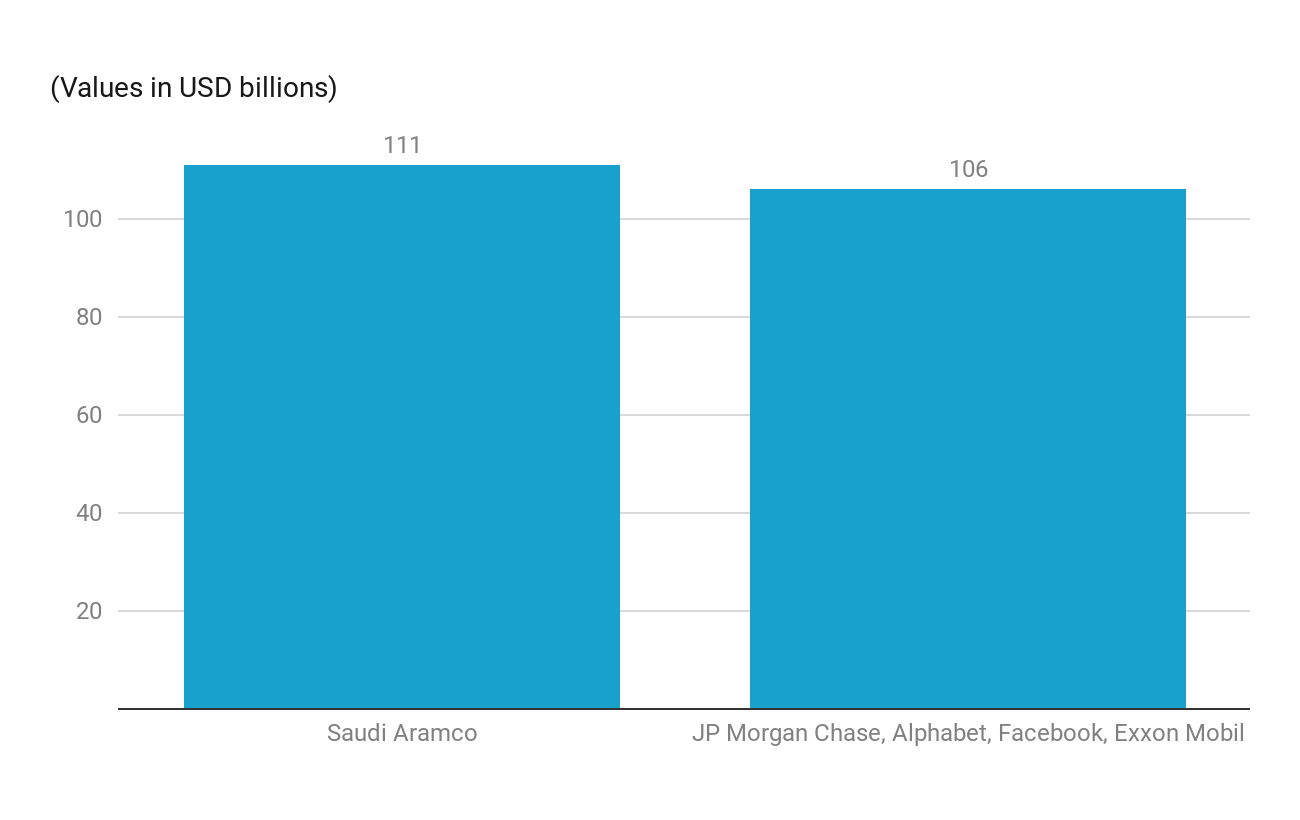

To put it in another perspective, Aramco made more money than J.P. Morgan Chase, Google-parent Alphabet, Facebook and Exxon Mobil combined.

Put together, these U.S. companies made nearly $106 billion in 2018, according to FactSet

Aramco as the most profitable company in the world, is for reasons.

First of all, Aramco has both the world's second-largest proven crude oil reserves, at more than 270 billion barrels, and second-largest daily oil production. Second, Aramco also operates the world's largest single hydrocarbon network, the Master Gas System.

Managing over one hundred oil and gas fields in Saudi Arabia, including 288.4 trillion standard cubic feet of natural gas reserves, Aramco also operates the Ghawar Field, which is the world's largest onshore oil field, and the Safaniya Field, considered the world's largest offshore oil field.

And lastly, the Saudi officials have backed an official figure of $2 trillion to Aramco's value.

Aramco made its financial information available in a prospectus (https://www.rns-pdf.londonstockexchange.com/rns/6727U_1-2019-4-1.pdf) to borrow up to $15 billion through a bond sale, in what could result in a more aggressive approach to capital-raising for both the company and Saudi Arabia, which is seeking to cut the country's dependence on oil and gas revenue.

The money is meant to help finance Aramco’s $69 billion purchase of most of a state-owned petrochemical company from Saudi Arabia’s sovereign wealth fund, whose chairman is Crown Prince Mohammed bin Salman.

But despite Aramco's record-breaking earnings, the company didn't receive top credit ratings from agencies like Moody’s, which issued a credit rating for Aramco, since Aramco is heavy dependence on the country’s economy.

The state-run oil company also faced drawbacks in its operations.

For instance, the Saudi government can determine how much oil Aramco should produce "based on its sovereign energy security goals or for any other reason."

So unlike Exxon and Chevron, its revenue streams are highly dependent on a single country that could face real instability risks.

Aramco can also face litigation over climate change or antitrust issues stemming from its membership in the Organization of the Petroleum Exporting Countries, especially in the U.S..

The financial results also show how the company’s income can rise and fall with the price of oil. In 2016, for instance, when oil prices were near their lowest levels in more than a decade, Aramco only earned $13.6 billion in net income.