Bitcoin was invented by Satoshi Nakamoto.

In a research paper called "Bitcoin: A Peer-to-Peer Electronic Cash System", Nakamoto implemented Bitcoin as an open source code.

In January 2009, the Bitcoin network came into existence with the release of the first Bitcoin client and the issuance of the first Bitcoins. Nakamoto was the the person mining the first block of Bitcoins ever, which had a reward of 50 Bitcoins.

The cryptocurrency is considered the mother of all cryptocurrencies, the most popular, and also the most expensive.

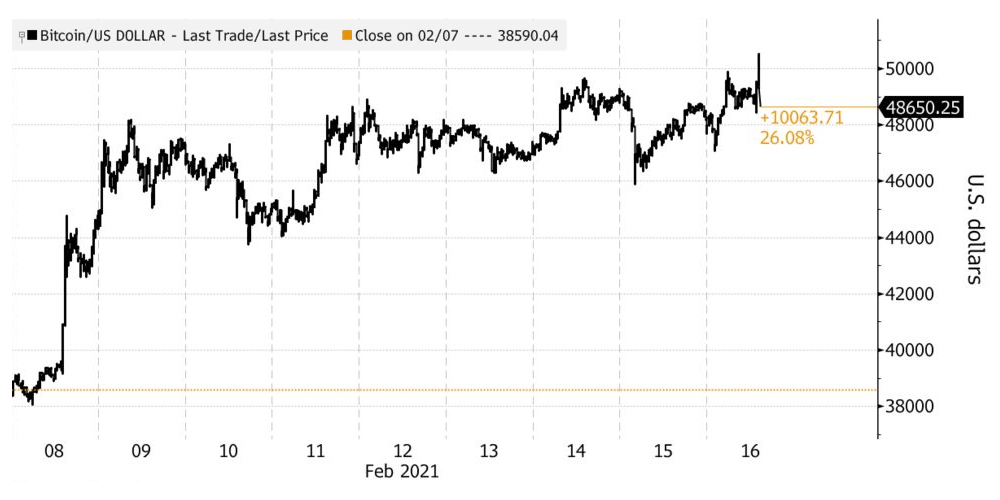

Despite remaining volatile, the trends were positive for the digital coin, especially shortly before and after Tesla bought $1.5 billion worth of the cryptocurrency as asset.

And this time, Bitcoin broke past the $50,000 level as the cryptocurrency continues its stunning rally when major companies appear to be warming themselves up for digital coins.

With major companies having their eyes on the cryptocurrency, the interest led many cryptocurrency investors to believe the bull run is different than past rallies.

Before, Bitcoin skyrocketed to nearly $20,000 in late 2017 before losing more than 80% of its value the following year. Bitcoin believers said that, whereas the 2017 bubble was driven by retail speculation, the 2020-2021 cycle is being fueled by demand from institutional investors.

Here, Bitcoin managed to double its value in less than two months.

The digital currency traded as high as $50,584.85, before closing at a slightly lower price, or up 0.95% for the day and 68% for the year, with a total market value in circulation close to $909 billion.

From August through December 2020, around 150,000 new Bitcoins were minted, with about 359,000 Bitcoins were bought in the same period.

That buying demand brought not only a price rally, but growing acceptance and recognition of an asset that was once an object of derision for regulators and lawmakers.

It's during this sudden surge that more and more people put interest in cryptocurrency.

Many started to believe that Bitcoin can be the source of investment, and wealth.

While most of Bitcoin's price resurgences were fueled by well-known Wall Street billionaires and big companies backing the cryptocurrency, there are skeptics that still see Bitcoin with skepticism.

Despite seeing the decentralized digital currency as an independent entity from any central authority, such as a central bank, those people see Bitcoin as a speculative asset with no intrinsic value and a market bubble that is likely to burst at some point.

In other words, skeptics see Bitcoin as a speculative asset, and worry that it may be one of the biggest market bubbles in history.

Related: Bitcoin Price Going Up To $30,000 And Beyond: Volatile But Liquid