The 'COVID-19' coronavirus pandemic has disrupted many of the world's ecosystem and economy, and made a lot of companies to file bankruptcy. But not for Apple.

Despite having experienced its own problems during the earlier days of the crisis, the Cupertino-based company is holding up strong.

After its earnings report, the company that was founded by Steve Wozniak and the late Steve Jobs, became the most valuable publicly traded company.

That is after Apple's shares closed up 10.47% Friday at $425.04, giving it a market capitalization of $1.84 trillion, according to the share count provided by Apple in a regulatory filing.

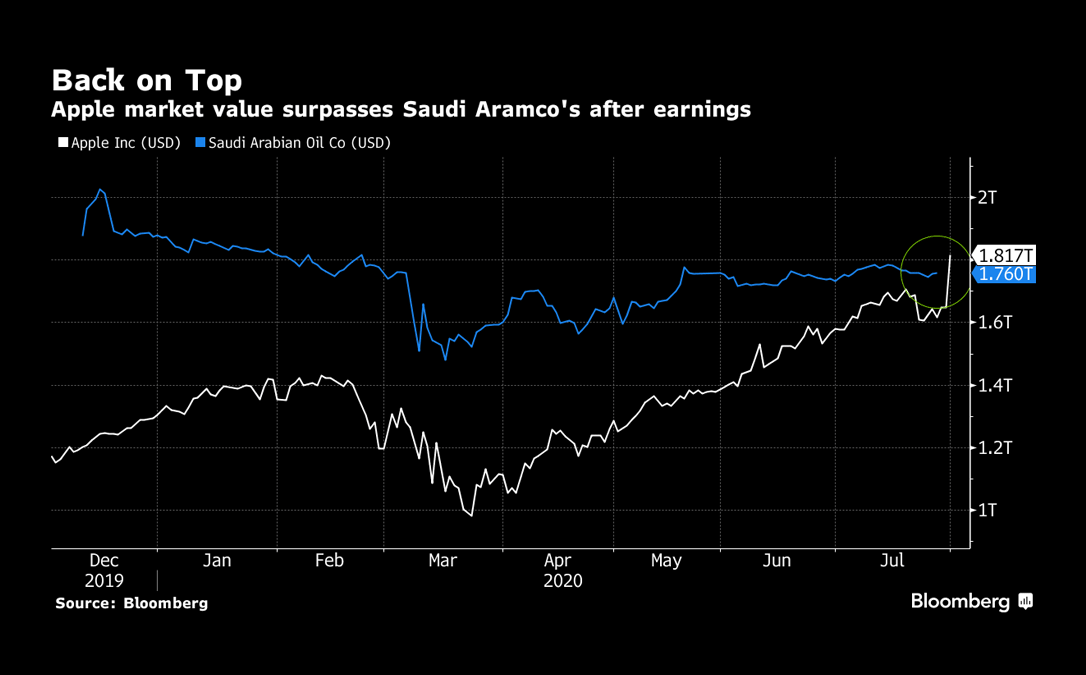

This is above the market capitalization of the state oil giant Saudi Arabia's Aramco, which had been the most valuable publicly listed company since its market debut in 2019.

The oil giant trails Apple at $1.76 trillion on the same day closing.

Related: Apple Becomes A $1 Trillion Company

This milestone was achieved after Apple disclosed its strong fiscal third quarter earnings, which was released on Thursday.

The good news boosted its stock. As investors are betting that Apple can emerge from the coronavirus pandemic stronger than smaller rivals, they quickly rallied behind the company's 11% year-over-year growth.

This happened after Apple bought back $16 billion worth of shares in the June quarter. The company had 4,275,634,000 outstanding shares, as of July 17, according to the filing.

Surpassing Aramco with the massive increase is regarded as one of Apple's largest one-day percentage gain since March 13, when it added $172 billion in market capitalization during the session, which is greater than the entire stock market value of Oracle.

In its quarterly report, Apple also announced a four-for-one stock split, with trading on a split-adjusted basis starting on August 31. What this means, investors holding one $400 share will have four $100

This is meant to be Apple's first share split since 2014.

Apple’s total revenue for the third-quarter hit $59.7 billion.

This was due to the strong Mac and iPad sales that were the highlight. Apple also saw an increased demand for its services, especially during the coronavirus lockdown in numerous countries.

Other American publicly-traded tech companies, like Amazon, Facebook, and Google, are also announcing their earnings. All of them posted good numbers.

Amazon for example, doubled its profit, even during the pandemic. Facebook on the other hand, saw a daily user increase of 12% year-over-year to 1.79 billion. And combined, the four companies netted $28.6 billion in profits.

The four companies kind of revealed that the tech industry isn't very much affected by the coronavirus pandemic, if they can transition workers to remote work, and sell their products to those who are working remotely. With this approach, tech companies like the four, are benefiting even when other industries are plummeting due to the coronavirus crisis.

It should be noted that at the time of Apple's filing, Aramco's second quarter report wasn't available.

Aramco's report is set for the public on August 9, and is meant to be the reflection of the overall state of the oil market in the quarter. However, analysts suggest that things aren't looking good for Aramco, knowing that in the first quarter of 2020, the company's profit fell 25%.

That was even before the coronavirus infiltrated the world and created widespread lockdowns.

Aramco’s stock was down 6.4% since the end of December, despite being far less than other oil companies. In comparison, Exxon Mobil Corp. has declined 40% and Royal Dutch Shell Plc has dropped 50%.

Further reading: Following Coronavirus Recovery In China, Sales For Apple's IPhone Soar 225%