In 2017, it was predicted that 40 percent of the world's Bitcoins were owned by just 1000 people. Then in a later research, it was concluded that more than half of all Bitcoins were owned by 1 percent of wallets.

This time, a research titled The State of Bitcoin, Long-Term Value Potential & Analysis concluded that 80 percent of all wallets holding Bitcoin only contain less than $100.

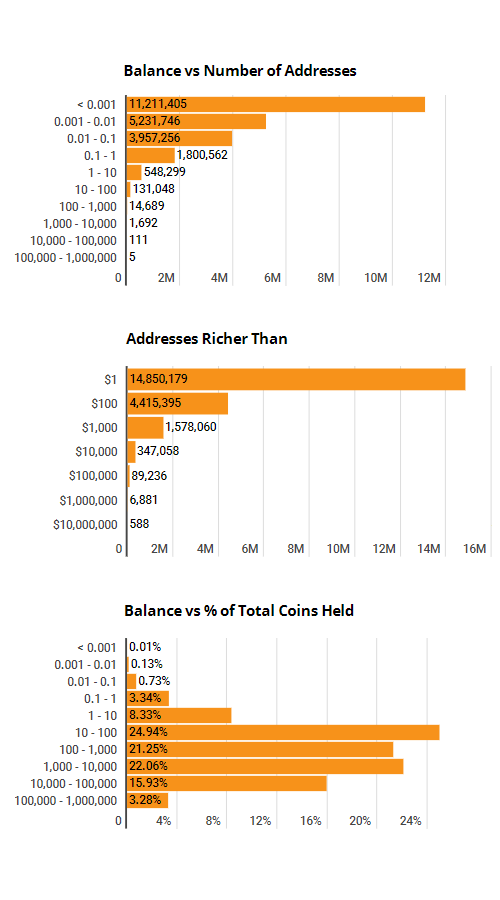

The analysis that was conducted by digital asset research firm Delphi found 22.9 million Bitcoin addresses holding just a small amount of Bitcoins, and nearly half of them contain less than 0.001 BTC ($3.40), and almost 90 percent hold less than one-tenth of a BTC ($340).

This is a contrast to the more than 1.5 million Bitcoin addresses which hold more than $1,000 worth of Bitcoins. By comparison, only 588 addresses that hold more than $10 million worth of Bitcoins.

According to Delphi, addresses containing 10 to 100 Bitcoins own 25 percent of the circulating Bitcoins, with the top groups having balances ranging from 100,000 BTC to 1,000,000 BTC ($341M – $3.4B).

What makes it interesting is these Bitcoin whales control a little more than 3 percent of the total Bitcoin supply. This means that the whales may have become even less active than before.

"... We can see that close to 50% of Bitcoin addresses have less than 0.001 BTC (which is around $3.70 as of December 5th). Additionally, only ~20% of addresses store more than $100 USD at the moment. Lastly, less than 700,000 addresses own 1 BTC or more at this time."

Bitcoin has gained astonishing popularity when its price skyrocketed in 2017. Since then, the demand for this cryptocurrency remains high, despite the price in 2018 has plummeted.

The cryptocurrency has a finite supply, at 21 million given that its inflation schedule is predefined and governed by a mathematical algorithm. The vast majority of Bitcoin have already been mined, but there are a significant amount of Bitcoins (~2-3 million) presumed to be lost.

According to Delphi, Bitcoin's market cap is at $67,163,150,400. And this value can vary upon demand and scarcity, because again, the cryptocurrency has limited supply. This makes Bitcoin an idea asset for this purpose, said Delphi.

Bitcoin's inflation rate has been falling dramatically since its inception, and in 2018 the annualized rate was 3.85 percent.

"Periods where a heavy supply of bitcoin was regularly coming to market has already passed, especially given miners are typically some of the largest sellers (in order to fund operations). We expect future increased demand to coincide with a lack of new supply, reinforcing our long term outlook on bitcoin's potential price performance."