Bitcoin was originally intended to be a fast, secure and inexpensive means of making payments without using the traditional financial system. The cryptocurrency's initial vision, was to become the "peer-to-peer electronic cash system."

But its initial design, has proven to be incapable of accommodating growing demands, without altering its original vision.

The problem lies deep inside the heart of its design: When someone buys or sells something using bitcoin, that transaction is broadcast to the entire bitcoin network. So no matter how big or small a payment is, it's stored in a network compromising hundreds of thousands of computers.

Poon and Thaddeus Dryja were bitcoin-obsessed engineers, and they had an idea which was to eliminate one bitcoin's huge problem: increasing the limit of transaction.

The bitcoin network is designed to effectively limits it to handle three to seven transactions per second, and this is far if compared to Visa that is able to process tens of thousands of transactions per second.

With bitcoin’s popularity soaring, there should be a way to make the system handle more transactions.

And here, Poon and Dryja acknowledged that for bitcoin to reach its full potential, it needed one big fix.

They revealed their work at a San Francisco bitcoin meetup, calling the project as the 'Lightning Network,' a system that can be implemented into cryptocurrency’s existing blockchain. With extra layer of code in place, they believed that bitcoin could support far more transactions and make them almost-instant, reliable and at the same time, cheap.

What this means, the technology can fulfill the cryptocurrency dream originally set out by Satoshi Nakamoto in 2008.

As the news about their project spreads, blockchain enthusiasts started hashing out its technical details in blogs and on social media. Engineers started implementing Poon and Dryja’s paper into working code.

Isolated groups that developed the network, worked together to release a version 1.0 of the Lightning Network.

A micropayment blogging site built for demonstration purposes by programmer Alex Bosworth. separately used the network to pay a phone bill with his own bitcoin. As he tweeted in late December, "Speed: Instant. Fee: Zero. Future: Almost Here."

Blockchains are networks that are composed of literal blocks, collections of transactions that are organized into chunks of data.

In order for a transaction to validate, miners must perform computationally procedures to put the new data into a new block. This procedure is resource-incentive, and takes an average of 10 minutes. About 2,000 transactions can fit into a block, so backlogs of unconfirmed transactions are common in bitcoins.

Read: Bitcoin Mining Consumes More Electricity Than 159 Countries In The World

And because each block has a limited space, bitcoin spenders attach a free to pay miners to include their transaction before others.

But as the backlog of payments grows, spenders offer increasing fees to attract miners to their transactions. As a result, the rising transaction volumes are causing network congestion, and bitcoin has no means of adjusting capacity other than rationing verification.

Developers have proposed ways to fix bitcoin's "flawed" blockchain technology. But only a few have the momentum. And Lightning Network, is one that has proven itself very capable becoming a game-changer.

The idea of Lightning Network, is to make most payments to not be recorded in bitcoin's ledger. Instead, they can take place in private channels between users. The Lightning Network’s builders want to move the bulk of payments to private channels and use the blockchain as a secure fallback, to ensure honest transaction.

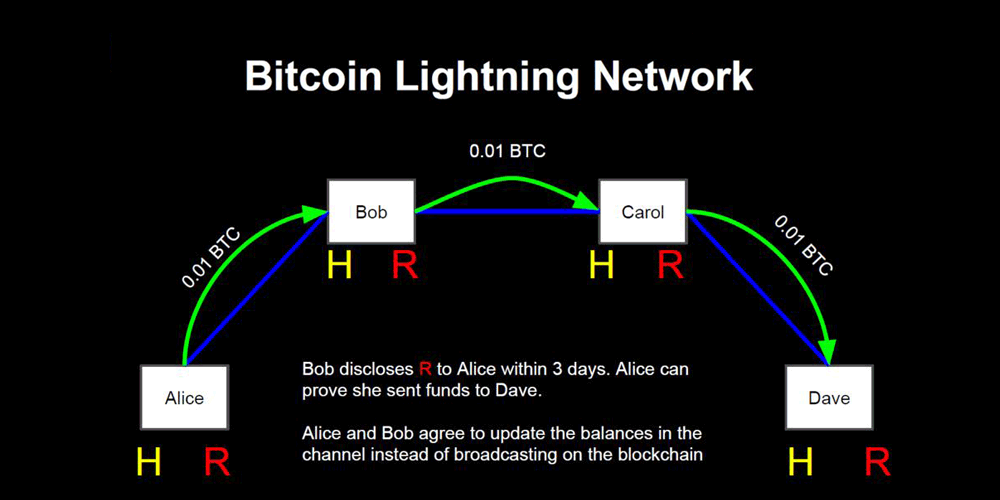

Using the Lightning Network, both the buyer and the seller can open a channel and commit funds into it. The channel then gets broadcast to the blockchain and incurs the normal bitcoin transaction fee. The channel can stay open for however long - during which time the two parties can exchange as many payments as they like for free.

And when the time expires, the channel closes and broadcasts the final state of the pair’s transactions into the blockchain, incurring another transaction fee.

Then, if one party believes at some point that he or she was scammed, the aggrieved individual can broadcast the contested transaction to the blockchain, where other users can verify it and miners can update the ledger, forcing the scammer to forfeit funds.

Lightning here, is a decentralized network of pre-funded, bilateral bitcoin payment channels off the bitcoin blockchain. What this means, arrangements can be done at normal internet speed. And this arrangement should work well with parties that frequently do businesses together.

The one innovation that can really be a game-changer is that channels can stay open indefinitely when they connect into vast networks. The system’s design includes extra cryptographic features that allow users to send payments safely, not only through their direct connections but also across their extended networks.

And if there are enough people that open the Lightning payment channels, there will eventually be a sizable bitcoin liquidity pool to be distributed across the network.

To share them, Lightning developers designs a routing facility that identifies which network nodes have sufficient funds to make a payment, and calculate the shortest viable route to the payment destination across all those nodes, and then send the payment.

Lighting transactions are typically small, and most are not broadcast to the blockchain. What this means, transactions should be a lot faster and cheaper than on-chain bitcoin transactions.

But there are two potential problems.

The first is that Lightning Networks's pre-funded channels have tied up funds that could be used for other purposes. Because of this, people may choose to keep very low balances in their Lightning channels, topping them up only when needed.

The second is that channel funding can change constantly. Usually, people would only fund their channel, then pay the balance down gradually. After a funding, there could be a large balance, but days later, that balance may diminish.

What the two problems do, is making liquidity across the network vary considerably. This would mean that, at times, particularly for large payments, it could be difficult or even impossible to find a payment route. Therefore, the Lightning Network could prove as illiquid as bitcoin.

In order to solve this issue, channels should be kept open and fully funded all the time. But this would mean that Lightning Network would be centralized.

An alternative would be to allow channels to temporarily go into deficit as a payment passes through. This would ensure that payments always settled, but would breach the "gold standard" principle of bitcoin. If gold is needed to settle payments, and a person isn't having enough gold, they the payment can't be settled.

This is where Lightning Technology fails. Initially, the project should see a difficult time in resolving bitcoin's long-known problem. However, it's a work in progress, and this means the future is yet to be written.

Read: How Blockchain Technology Can Change The Way Modern Businesses Work