Out of the few precious metals used by many for investments, gold is the most popular.

Investors ]generally buy gold as a way of diversifying risk, especially through the use of futures contracts and derivatives. While this precious metal is also subject to speculation and volatility as are other sorts of investments, but gold is considered the most effective safe haven and hedging properties across a number of countries.

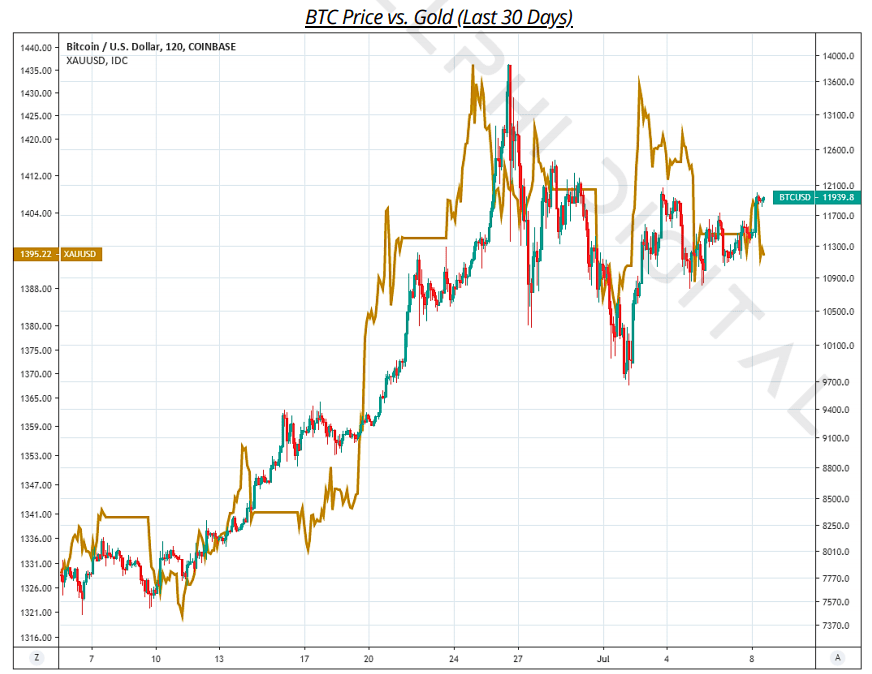

Bitcoin and gold have been compared many times, and here, a report from Delphi Digital showed that the two assets performed almost identically for about a month.

The company warned that Bitcoin is still volatile in nature, but political and economic factors could favor the cryptocurrency in the near future.

"Dovish central banks, falling sovereign debt yields, a growing US budget deficit, and talks of additional stimulus beyond ‘conventional’ policies all contribute to a supportive macro backdrop for Bitcoin to thrive," said Delphi Digital.

Bitcoin is often dubbed the "digital gold," and pitched as an alternative to the precious metal.

Gold, while considered one of the best investments, can experience poor performance, one of which can be caused from the lack of clarity on the U.S. Federal Reserves’ outlook for interest rate cuts.

And just like most commodities, the price of gold is driven by supply and demand, including speculative demand. With more people investing in gold, the quantity of gold stored above ground compared to the annual production, affects the price of gold by changes in sentiment, which in turn affects market supply and demand equally.

Central banks and the International Monetary Fund also play an important role in the gold price.

But what really made gold a valuable and precious metal, can go back to the days in history, when the society simply agreed that this yellowish metal should represent 'money'. From that day forward - as that idea spread virally across the globe - gold came to be worth something more than what it previously was.

Other precious metals include silver, platinum, palladium and more.

And Bitcoin, while isn't a precious metal at all, is just one contender, because of the way people agreed that its price and influence are independent and not backed by any entities or banks.

Both gold and Bitcoin are relative to fiat currency, are inconvenient for day to day use. Gold coins and Bitcoins won't do much good at the everyday society for purchasing goods, for example. Both lack intrinsic value.

But they have proved helpful to investors, as at some points in their lives, they have been leveraged as speculative investments or safe-haven assets.

Both have value only because society has confidence that they will maintain said value over time.

Bitcoin, of course, has been around only since 2009, so it doesn’t have the same kind of long term credibility. But the Bitcoin supply is just like gold, as it is constrained, built into its elegant mathematical model.

There’s hard limit of 21 million Bitcoins to be mined.

Bitcoin is designed for a society that lives through the internet. With the ideals of the contemporary cyber movement in mind: decentralization, peer to peer, cryptography, the cryptocurrency is easily transferable, making it valuable for the virtual society. As a payment system, it's a temporal store of money that can be easily sent across the globe securely and speedily without counterparty risk.

No matter the price of bitcoin, these benefits will always give it purpose.

So as Bitcoin demand and adoption continue to outpace its supply, its price should increase.

And this can make Bitcoin a viable alternative to gold.