Humans in using oil and gas can be dated back to thousands of years. Since then, the two commodities have become their own industries, as demand kept on rising.

Buying and selling commodities such as oil and gas is traditionally paper-based. What this means, credit notes and invoices have to be completed manually, and then emailed, faxed, or even posted to the relevant parties.

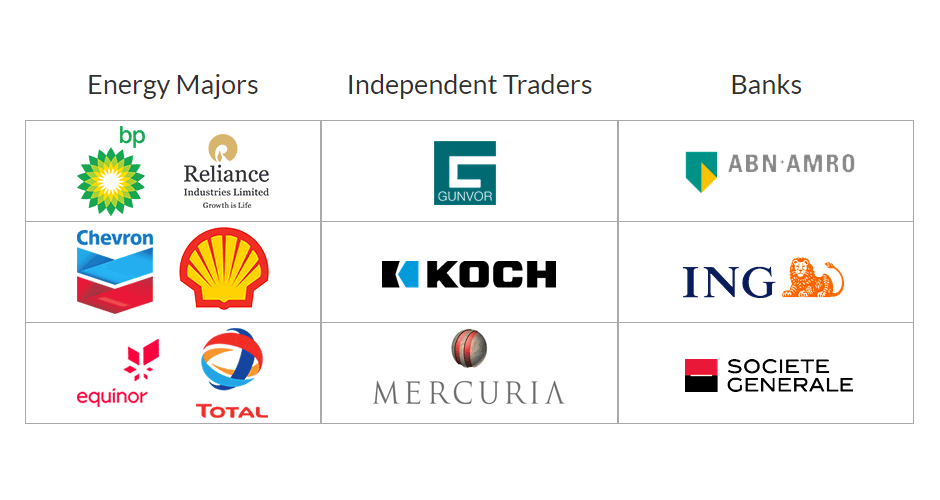

The industry consortium that include BP and Equinor, Royal Dutch Shell, Gunvor, Mercuria, Koch Supply and Trading, ABN Amro, ING, and Societe Generale, is trying to change that using blockchain technology. They were later joined by other petrochemical and oil giants - including Chevron, Total, and Reliance.

The world leading energy producers and banks have partnered, and launched a blockchain-based trading platform for physical oil trades. The technology is based on JP Morgan's blockchain, a platform that is considered the first functional blockchain-based trading platform for oil and gas industry.

Known as VAKT, the consortium believes that putting the trading process on blockchain would make it faster, cheaper and also more secure.

VAKT Chief Executive John Jimenez said that his company would facilitate the post-trade settlement for a physical deal involving North Sea crude, adding that it is also seeking for other opportunities in the U.S. crude pipeline market, as well as the European products market.

"We chose the North Sea crude market because it is a contained market where we don't have to deal with too many players," said Jimenez, at the Digital Commodities Summit, organized by S&P Global Platts, in Singapore.

Jimenez said that VAKT has been performing proof-of-concept work.

"This is not just for the consortium," Jimenez said, explaining that the VAKT platform has been approached by around 50 companies that are eager to join the platform. "It's a solution for the industry. We need to have many companies which will bring different needs and value."

"We’ve been overwhelmed by the strength of response to the VAKT concept. Launching into our first market with such high-caliber first users is a transformational moment for us and the industry. But it’s just the start: success for a blockchain solution depends on widespread adoption and we’re looking forward to seeing the ecosystem grow.” explained Jimenez, who is also a former executive at BP.

Using blockchain, participants can store their transactional information through a "distributed ledger", which eliminates the needs for a centralized intermediary.

This speeds up the process of storing and sharing data, in an encrypted and secured manner. Things are also transparent to the parties. The end goal is to improve data security and efficiency in a streamlined commodity trading, as well as cost-cutting through the replacement of redundant processes.

"Blockchain reduces cyber risks, the costs of trade finance and fraud," Jimenez stated.

The digital technology nonetheless has the potential to be disruptive to the traditional roles of traders, banks and clearing houses, all of which deal with risk mitigation.

Initially, VAKT's blockchain solution is only available to the members of the consortium, and set to open to the wider market in January 2019.