China is the giant from the East. As the most powerful country in Asia, it has indeed conquered pretty much of the Asian market, and even beyond.

And tech is one of them.

And among those in the tech business, Alibaba is one of the largest. Due to its size and influence, China kicked off an investigation into the alleged monopolistic practices at Alibaba Group Holding Ltd. and summoned affiliate Ant Group Co. to a high-level meeting over financial regulations.

This escalates scrutiny over the two empires controlled by billionaire Jack Ma.

The probe was announced on December 24, the day that marked the formal start of the Communist Party’s crackdown on Ma’s massive business that spans everything from e-commerce to logistics and social media.

The Chinese government is known for its censorship and control over contents. And this pressure on Ma is central to a broader effort to increase the government's control over the Chinese internet.

Jack Ma's twin empire is hailed as one of the drivers of economic prosperity, and also the symbol of the country's technological prowess.

This is something China can boast to the West.

But still, Ma's companies have grown too large and powerful that they have become "too-big-to-fail" entities.

Just like rival Tencent and Baidu, powerful tech companies in China are under pressure from regulators.

Due to the country’s internet ecosystem, tech companies are long protected from competition by the likes of Google and Facebook. As a result, Alibaba, Tencent and some others dominate the country's tech sphere with literally no competition to be worried of.

Going beyond that, those giant companies have also invested in a vast majority of the country’s startups, including on the food and travel giant Meituan and Didi Chuxing. Only a few live outside the grip of Alibaba and Tencent, with the largest being TikTok-owner ByteDance Ltd..

And here, the investigation follows the draft for anti-monopoly rules that was released in November 2020. The rules gave the government the ability to restrain entrepreneurs who until were enjoying unusual freedom to expand their realms.

As a start, the State Administration for Market Regulation investigates Alibaba, with regulators that include the central bank and banking watchdog.

The People’s Daily, the mouthpiece of the Communist Party, warned that fighting alleged monopolies was now a top priority, saying that “anti-monopoly has become an urgent issue that concerns all matters.” In a commentary coinciding with the probe’s announcement. “wild growth” in markets needs to be curbed by law, it added.

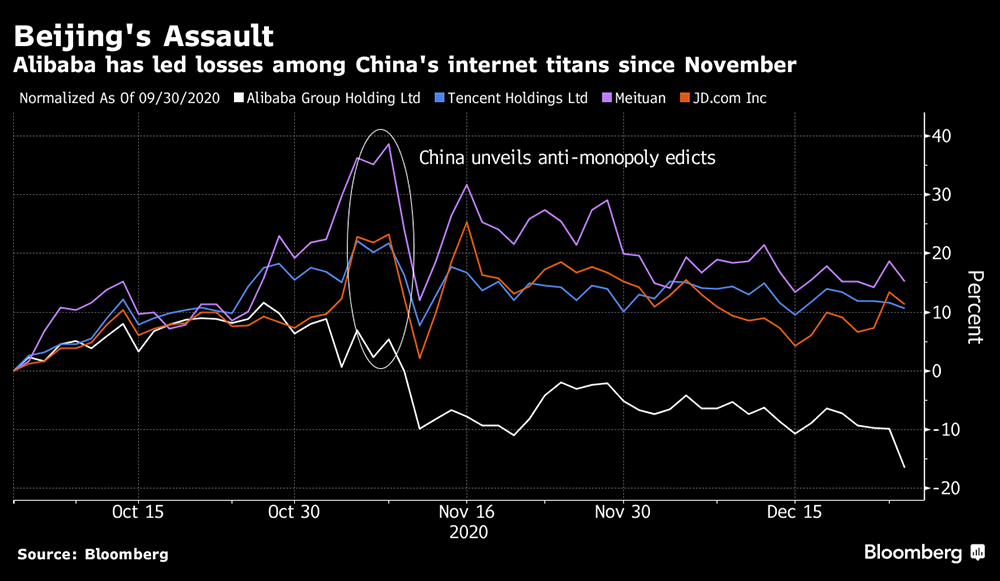

Following the news of China's investigation on Alibaba and Ant, Alibaba's shares slid 8% in Hong Kong. Tencent is already one of China's tech biggest losses since Ant's IPO was halted. Tencent and internet services giant Meituan was more than 2.6% lower, while SoftBank Group Corp., Alibaba’s largest shareholder, sank 1.7% in Tokyo.

Overall, the lost is about $200 billion.

Alibaba said in a statement it will cooperate with regulators in their investigation, and that its operations remain normal.

As for investors, they remain divided over the extent to which Beijing will go after Alibaba, as Beijing prepares to roll out the new anti-monopoly regulations. At this time, people can only speculate because the country’s leaders have said little about how harshly they plan to apply the regulations.