Bitcoin has experienced its glorious moments back in 2017. But since then, the value of the cryptocurrency, while remaining unstable and volatile, was never anymore that bright.

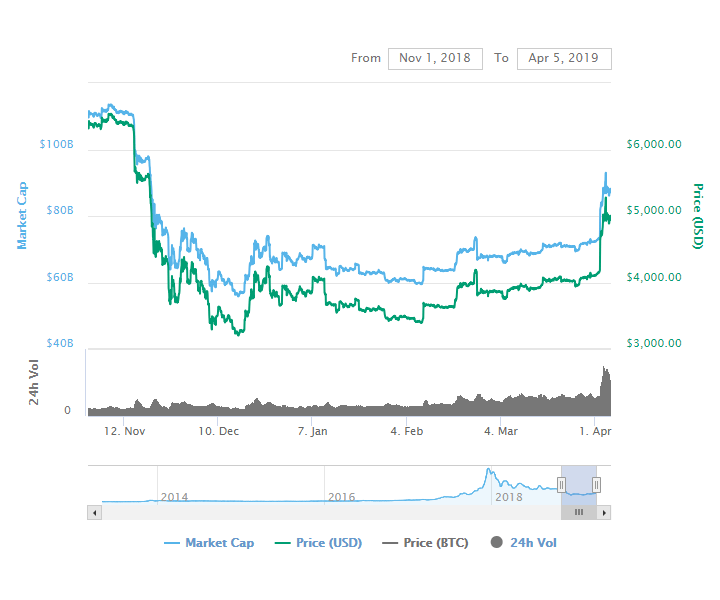

But during an Asian trade, Bitcoin's value suddenly past $5,000 for the first time since November 2018. This 20 percent increase in value makes it the biggest one-day gain in the past year, according to Reuters.

It was claimed that over the course of six hours, a "mystery buyer" was responsible for this.

According to Oliver von Landsberg-Sadie, chief executive of cryptocurrency firm BCB Group, the movement was likely the result of a single buyer, who used a computer algorithm to trigger the purchase of $100 million worth of Bitcoin spread between cryptocurrency exchanges Coinbase, Kraken, and Bitstamp.

"There has been a single order that has been algorithmically-managed across these three venues, of around 20,000 BTC," he said.

"If you look at the volumes on each of those three exchanges – there were in-concert, synchronized, units of volume of around 7,000 BTC in an hour."

During the period, there were 6 million trades for every hour during the price rise, mostly concentrated on Asia-based exchanges. This was three to four times the usual trading volume.

"You trigger other order books to play catch up, and that creates a buying frenzy," von Landsberg commented.

The sudden surge sent smaller cryptocurrencies, known as “altcoins,” to trade higher as well. Ethereum’s ether and Ripple’s XRP, respectively the second- and third-largest coins, have jumped by more than 10 percent.

The reason for this was because prices of smaller coins tend to be correlated to Bitcoin, which accounts for just over half of the value of the cryptocurrency market.

Still, analysts could not point to any specific developments that could explain the mystery buyer’s big order.

Trade has since calmed, with the price remaining steady at around $4,700 across major exchanges.

Bitcoin‘s price famously almost hit $20,000 in December 2017, considered the peak of a bubble driven by retail investors.

Since then its price has been gradually falling.

Bitcoin surged to near $20,000 in late 2017,. In 2018, its prices collapsed by three-quarters, with trading dominated by smaller hedge funds and crypto-related firms.And by February 2019, the cryptocurrency market was sluggish as it entered the longest Bitcoin bear market in its history.

Through this period of relative calm, Bitcoin was trading around $3,300 and $4,200.

After the big hype and the big fall, big institutional investors have largely stayed on the sidelines. They were concerned over security breaches and regulatory uncertainty as reasons for the lack of mainstream enthusiasm in digital coins.

And as for the sudden spike, this price movement is frequently seen in cryptocurrency markets, where liquidity is thin and prices opaque. This is a contrast to conventional markets where prices are relatively stable.

Related: Bitcoin At $15,000. A 50 Percent Increase In Just Two Weeks