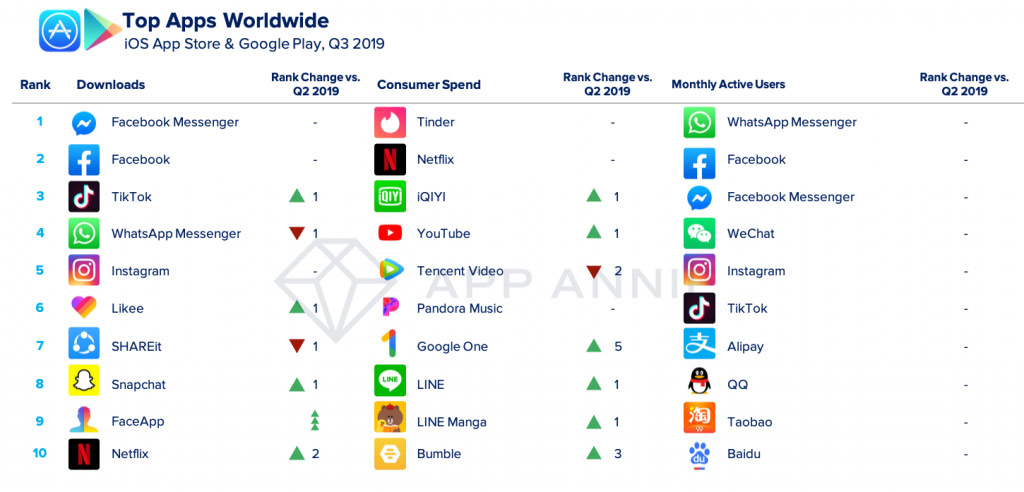

According to an insight market data report from App Annie, six of the world’s ten most-used mobile apps are owned by Chinese companies.

And as for the remaining four apps, they are all owned by Facebook.

Chinese companies also dominate when it comes to mobile games, in which App Annie reported that they account for 40% of all global app downloads.

Asia’s digital influence isn’t limited to Chinese companies, and organizations, as companies/developers in Japan and Korea are consistently delivering some of the world’s most popular apps too.

While many Western-made software and services have established a strong foothold, many in Asia are gaining.

For example, Asian websites are increasingly dominating the world’s most-visited online destinations, with China’s e-commerce platforms showing particular success.

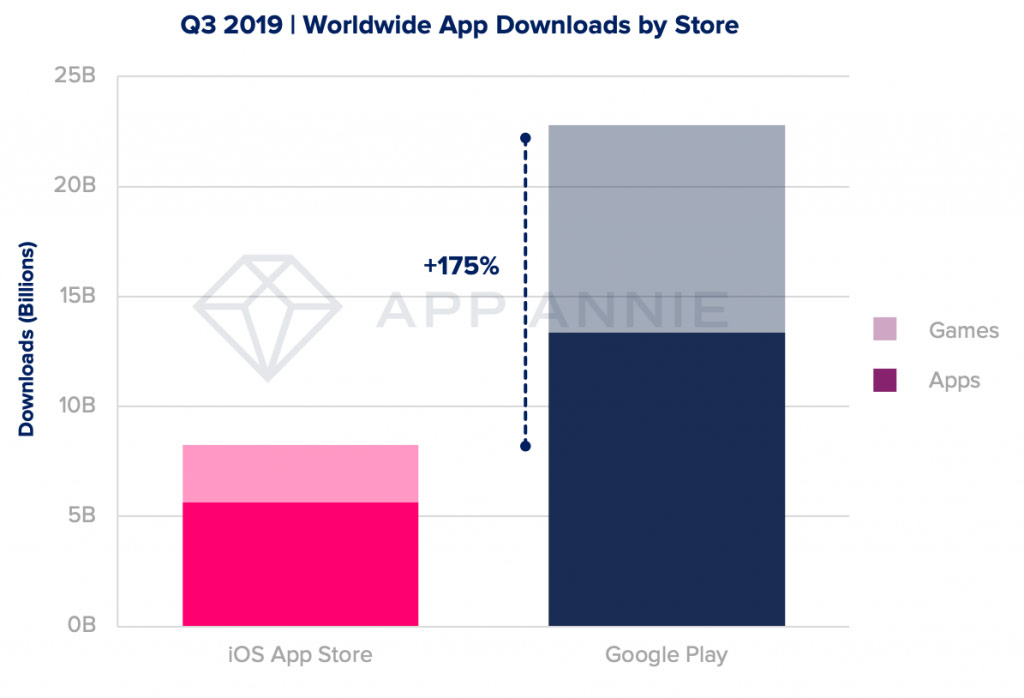

As for the app stores, both Google Play and Apple's App Store benefit from this increasing growth.

Globally, there were over 31 billion app downloads in Q3 2019. This is an increase of up to 10% year-over-year. And here, Google Play downloads grew 10% year-over-year in Q3 2019 to nearly 23 billion, while iOS downloads remained stable. Google Play continues to lead iOS in downloads by 175%.

Consumer spend across both app stores grew by about 20%. Non-gaming apps accounted for 35% of consumer spend on iOS compared to 20% on Google Play. This represents nearly 10% growth quarter-over-quarter for Google Play.

The key markets driving year-over-year growth in iOS consumer spend remained the same as last quarter: the U.S., Japan and China, with Japan growing over 30% year-over-year.

On Google Play, the U.S., South Korea and Germany were the top contributors to year-over-year growth in consumer spend, with Germany replacing Japan from Q2 2019. In terms of year-over-year growth of market share, the top 3 were the U.S., Russia, and Germany.

While games contribute much to the growth, non-games also experience substantial growth.

For example, consumer spend on Google Play on categories like Social, Productivity, and Entertainment, are showing positive gains. Among Productivity apps, a number of cloud storage solutions (like Google One, Dropbox) were the key segments behind the growth of consumer spend.

On iOS, apps that are not games that experienced positive gains were on categories like Photo & Video, Entertainment, and Music. Photo & Video, Music and Education in particular, outpaced overall growth among non-gaming apps.

Among non-gaming apps, Shopping, Food and Drink, and Health and Fitness were the top categories contributing to year-over-year growth of downloads in the quarter. Food and Drink apps saw particularly strong year-over-year download growth at 10%.

Google Play downloads grew 10% year-over-year in Q3 2019 to nearly 23 billion, while iOS downloads remained stable.

And as for the markets, again the Westerns are relatively more stable. But in emerging markets however, like India and Brazil, the two countries experienced huge growth. Russia here came third.

China, the U.S. and Japan were the largest markets for iOS downloads in Q3 2019. However, the U.S., Saudi Arabia, and Brazil drove the largest absolute growth year-over-year.

Related: Q4 2019: The Internet With 4.47 Billion Users, With Social Media Users Still Climbiing