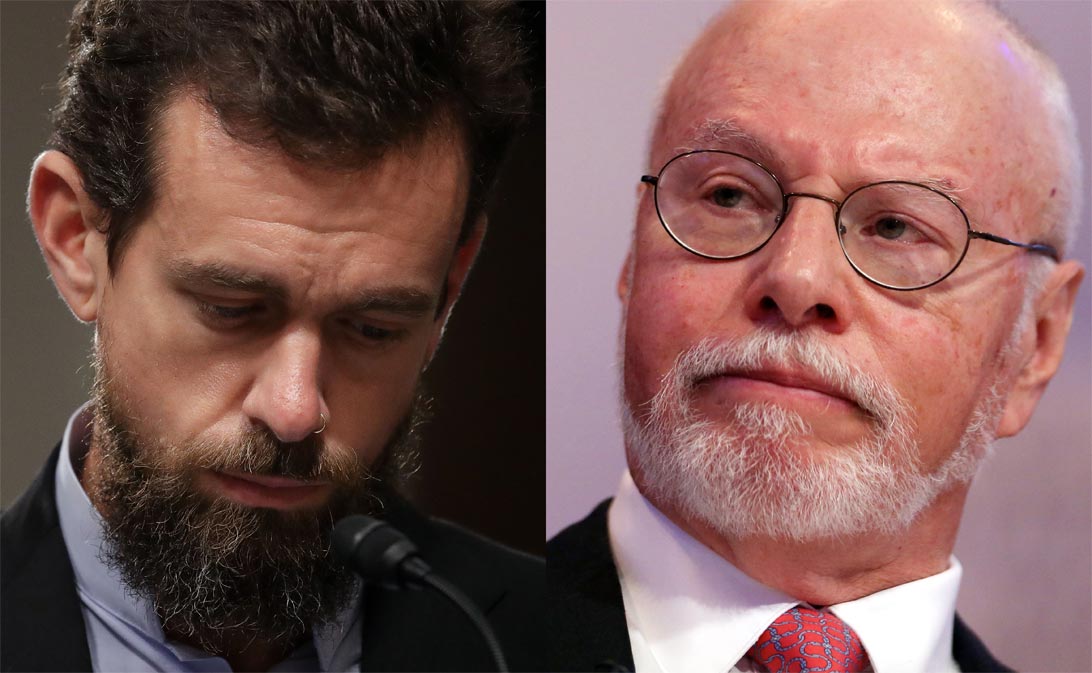

Paul Singer is a billionaire hedge fund manager and founder of Elliott Management Corporation that specializes in distressed debt acquisitions. Through his company, the philanthropist has purchased a "sizable stake" in Twitter Inc., and plans to push for changes at the social media company.

And according to people familiar with the matter, he also wants to replace Twitter's founder and CEO Jack Dorsey.

For his motives, New York-based Elliott is one of the world’s biggest activist investors.

Founded by Singer, the company is known to regularly push changes in companies it buys shares, to improve operations and ultimately the share price.

Previously, Elliott disclosed a stake in Japan’s SoftBank Corp. and said it planned to push for a larger share buyback and governance changes at the firm’s Vision Fund. Elliott has also pushed for changes at AT&T Inc., eBay Inc., Marathon Petroleum Corp. and Pernod Ricard SA.

Elliott’s push to Twitter comes at a pivotal time with the U.S. election about to take place, Summer Olympics and other major events, like the spread of the novel Wuhan coronavirus, which tend to all attract more users and more advertisers to Twitter.

Elliot managed to take advantage of the situation, because Twitter only has one class of stock, which means that co-founder Dorsey doesn’t have voting control of the company like Facebook Inc.’s Mark Zuckerberg or Snap Inc. co-founders Evan Spiegel.

Singer also takes advantage of Dorsey's only 2% stake at Twitter, and his position as the CEO of two large companies at the same time (Dorsey also runs Square, Inc.).

This makes Dorsey vulnerable and a potential target for criticism whenever Twitter stumbles.

Other stakeholders have also voiced concern about Dorsey’s leadership as Twitter's share price struggle. Since Dorsey returned as CEO in July 2015 replacing Dick Costolo, the company’s shares have fallen 6.2%, while Facebook’s have gained more than 121% during that time.

But still, the company managed to report a quarterly revenue above $1 billion for the first time.

News of the Elliott stake saw Twitter’s share price rise on Friday in after-hours trading, jumping by 7.7% to $33.20, giving the company a market value of about $26 billion.

Singer is a Republican donor who opposed Donald Trump during the real-estate magnate’s run for the Presidential election.

That before he changed his mind and donated $1 million to Trump’s inaugural committee, after initially supporting senator Marco Rubio’s presidential campaign ahead of the 2016 election.

Trump claimed in 2016 that he was self-funding his campaign so he couldn’t be “controlled” by donors, even though he ultimately raised most of his funds from outsiders, and even spent a significant amount of his time away from the White House fundraising from them.

With the U.S. President famously communicates with the public through his Twitter handle, many times since then, Twitter made headlines when it failed to curb fake news and potential media manipulation.

From Trump to Michael Bloomberg and others politicians, Twitter has become a place where officials express their opinions and oppose others.

As of January 2020, Singer has a net worth of $3.5 billion.