Alphabet is Google's parent company, a conglomerate that heads multiple services from simple to outstanding and outrageous. When the company announced its profits, people are having a glimpse of the financial data of what could be one of the most valuable company in the world.

Alphabet is Google's parent company, a conglomerate that heads multiple services from simple to outstanding and outrageous. When the company announced its profits, people are having a glimpse of the financial data of what could be one of the most valuable company in the world.

Alphabet is formerly known as Google, and it's setting itself to become the world's largest publicly traded company thanks to a significant increase in its share price. Following how great Alphabet and Google are in making money, they're also showing how "good" they are in spending their money.

Since Google restructured to become Alphabet, it's market valuation has increased by $200 billion, or almost double its value. What comes as an astonishment is that none of Alphabet's products were doing any significant move during its restructuring period; pretty much intact without major commercial, political nor legal advancement. But all those products steadily brought billions to the company.

Despite being the parent of Google, Alphabet is still having a vast majority of its revenues coming from Google (from Search, Maps, YouTube, etc.).

Alphabet is what represents the future of the industry; it's the company that generates much talks but not that much money, and occupy one side of the balance. Its subsidiaries include Nest Labs, Google Fiber, Calico, X, GV, Verily, Google Capital, and Google itself. Google that is under Sundar Pichai, takes the other role to even the scale by paying most of the bills and expenses.

Search That Made Google

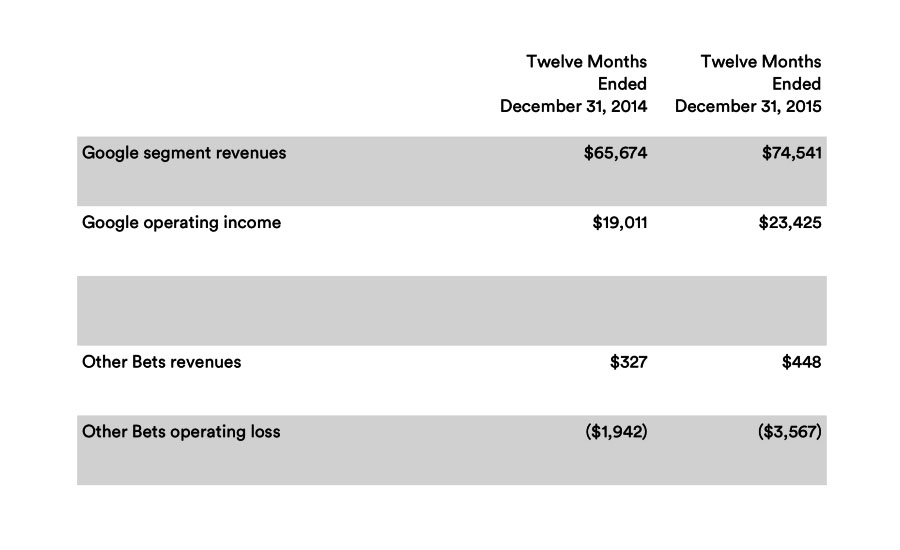

With the many products Google has under its sleeves, Google's main income comes from its advertising network. As the largest on the web, Google commands the segment with $74.5 billion in 2015 ($23.4 billion profit).

What comes on top is none others than its famous Search. Built by Larry Page and Sergey Brin, Search has proven itself to be the most valuable asset Google has under its disposal. It's the jewel in its inventory that gives the company its biggest source of revenue: $13.03 billion in 2015 alone.

What made Search important and so heavily influential can be traced back from its history. On the early days of Google, PageRank is an invention that first started the rise of Search. The algorithm ranks websites according to their popularity, making each of them unique in the Search results page. What sparks the early competition of websites on the web, Search and algorithms simply rank every page Google sees, and count a link as a vote. So the more a page has links coming to it, the more respectable it is.

At the time of the launch, Google's Search has given the browsing experience that was way better than any of the competition. Google kept its secrets tight, and its strategy is well paid off.

Google was founded in September 1998. A month later, Search is generating 10,000 searches from users a day. Six months later, 500,000 searches. A year later, 150 million. The number kept increasing, topping to 3.5 billion search queries a day in 2015.

When the internet grows large and the web became more populated, advertisers are flocking in. A higher the value a web page is regarded by Google, the more valuable it is to advertisers. This is because the page is having more links, more influence and more viewers. Advertisers want to win these people, and they're willing to put a lot of money for that. Furthermore, Google's own Search results page demonstrates a place that is very much valued to advertisers because of its high visibility.

Moving away from Page and Brin, the next early adjustment to Google came under Marissa Mayer. Before joining Yahoo! as its CEO, Mayer was in charge of Search. According to a 2005 profile, she was described as Google's high priestess of simplicity when she Google's became Vice President of Search Products and User Experience. Her job, she said, was the gatekeeper that made and kept Google within its identity.

Her job, she said, was as a gatekeeper: "I have to say no to a lot of people."

"Google has the functionality of a really complicated Swiss army knife, but the homepage is our way of approaching it closed," she once said. "It's simple, it's elegant, you can slip it in your pocket, but it's got the great doodad when you need it. A lot of our competitors are like a Swiss army knife open - and that can be intimidating and occasionally harmful."

Google Looking Forward

While Search alone is a huge money maker, Google was closely observing the trends that came when the world started to flourish under the web. Search was, and still is, a massive source of revenue for Google, but it sees the future of ads in new areas: mobile and video.

To embrace the newer trends, Google bought YouTube for $1.6 billion. The video-streaming service that was founded in 2005 by Steve Chen, Chad Hurley and Jawed Kari, was already having a huge establishment on the web, but it was nowhere close to what it is today. YouTube, before being acquired by Google, had 100 million viewers a day, in 2015, the number is up to billions.

An estimate concluded that YouTube's ad revenue grew 40.6 percent, reaching its peak at $4.28 billion.

In August 2005, the same year when Google bought YouTube, Google also bought Android. The mobile operating system developed by a team led by Andy Rubin may give less profit than most other Google products: as of 2015, Android in its lifetime only generated $31 billion for Google, or a little over a 3 billion a year. But it's the one that ended Google at the top of the chart within the mobile industry, with no others capable to compete besides itself and Apple's iOS.

With a $50 million price tag when Google acquired it, Android is a bargain.

Android brought Google to the mobile sphere. Android's revenue comes from how Google is taking cut of sales out of apps and media, as well as the recent in-store ads. But that is not how the company is focusing. Google wants to share the operating system for the world to use, and not relentlessly trying to get profit from sales of handsets (like Apple), or from software (like Microsoft). What Google wanted and wants, is to create an army of Androids. Google succeeded this: as of 2015, Google sees 1.8 billion Android devices online (about four times the number of iPhones).

At the time, Google has it all: presence, influence, power and money. With those in its disposal, Google aimed for the unthinkable: the company wants to thrive not just today, but also tomorrow, the next year, following decades, and probably to the unforeseeable future. It's putting its eyes and more efforts to develop Artificial Intelligence (AI), Virtual Reality (VR), self-driving cars and many other moonshot projects.

As a way to make things more transparent (and better for Google), Alphabet is formed to be the parent company of Google and several other companies previously owned by or tied to Google. Shares of Google's stock have been converted into Alphabet stock, which trade under Google's former ticker symbols of "GOOG" and "GOOGL".

Google completed its reorganization into Alphabet on October 2nd, 2015.

Business Is A Business After All

What goes up, can go down. Every business knows that and so did Google. When preparing itself for a battle in the next decade(s), Google is piling up its resources to create, and overcome, many new possibilities the future has to offer.

But not everything that came from Google tops the chart. The company is known to make huge bets on technology. Many of Google's products never came out to the wild and never see the light of success, they're blundered and then flushed.

Google is famous for its moonshot projects that are either enormous or ambitious. The technology projects cost a ton to develop and some might not ever work or turn a profit. Some of those projects that are steadily increasing its chance in making profit, aren't yet generating good profit. For example: Project Fiber, delivery drones, self-driving cars, Nest, Google Loon, and so on. They're still under development, but not yet giving Google any good money.

From huge bets that never makes any noticeable profit, huge blunder like Google Glass, to the many development of products that are yet to become profitable, Google is bleeding money from many holes. They're all summing up to add expenses to Google.

In its profit announcement, Google for the first time broke down its finances into both Google revenues and losses, and a new category called "Other bets".

Under Other bets in which points down Google's revenue and loss from its "bets", Google said that is loses $3.5 billion in 2015. That loss is by far outnumber its revenue that came at $448 million. Other expenses that should come to a conclusion is Google aso has a significant increase in its expenses in 2015 if compare to 2014 ($65 billion to $74 billion).

So on one hand, Google is generating a huge cash, but it's also spending a lot of money. Some of its products generate a lot of talk but not much money, but nevertheless, that huge loss is nothing if compared to its profit.

Seeing The Future

When the trend shifts from traditional desktop computers to mobile, and from mobile to VR, and anything in between, Google's success is there for a reason: it's method of keeping things discreet, and leaving the rest for the world to develop. While Google keeps its main secret in Search to itself, it's slowly allowing people to get a glimpse of how Google is working in the background.

From the open-sourced Android to TensorFlow that is said to be the AI behind Google products, Google acknowledges that it couldn't grow on its own (at least to the foreseeable future) without having others giving it a hand. Making some of its products open-sourced means more people will be able to use and develop it. While those people will benefit from Google's product, or even able to create their own Google if they wanted to, what Google wants is to get all those usage data to create a better future of technology.

Data is the thing that drives Google to what it is now. Data is expensive, and Google is already known to be one of the single beings that holds pretty much everything on the web. And when it wants to venture onward, more data is just never enough. It needs a lot more.

The aim? To make a better future in tech in overall. Google is like wanting to make humans to see technology as themselves, it wants computers to become more human. And when that moment arrives, Google wants to make sure that it gets there first.

Maintaining Business

When Larry Page announced Alphabet, he said:

"As Sergey and I wrote in the original founders letter 11 years ago, 'Google is not a conventional company. We do not intend to become one.' As part of that, we also said that you could expect us to make 'smaller bets in areas that might seem very speculative or even strange when compared to our current businesses.' From the start, we’ve always strived to do more, and to do important and meaningful things with the resources we have."

What Google (Alphabet) is doing in the eye of investors is that it's free to do anything it likes, as long as its main core business is not showing any sign of weaknesses. Since Google's Search and other main products are thriving and growing happy, Google has more time and money to spend.

A simple question asked when questioning Alphabet's stock, the answer lies on how good Google's traditional business is growing, and how much of the money it generates will be funneled towards its moonshot (relentless spending) projects.

Investors had long been looking for signs that the core search business was making a smooth transition from desktop traditional computers to mobile phones, and that YouTube was becoming a driver of the new growth.

"Above all, our Q4 results show the great momentum and opportunity we have in mobile search and across Google's range of businesses," said Google's CEO Sundar Pichai

Net income was $4.9 billion versus $4.7 billion for the same period a year ago, beating Wall Street expectations. Shares of Alphabet were up more than 5 percent in after-hours trading. Alphabet that is spending $5 billion from its $73 billion cash to repurchase company stock, jumped 43 percent from 2014. This has put itself neck and neck with Apple that is the most valuable company in the world.