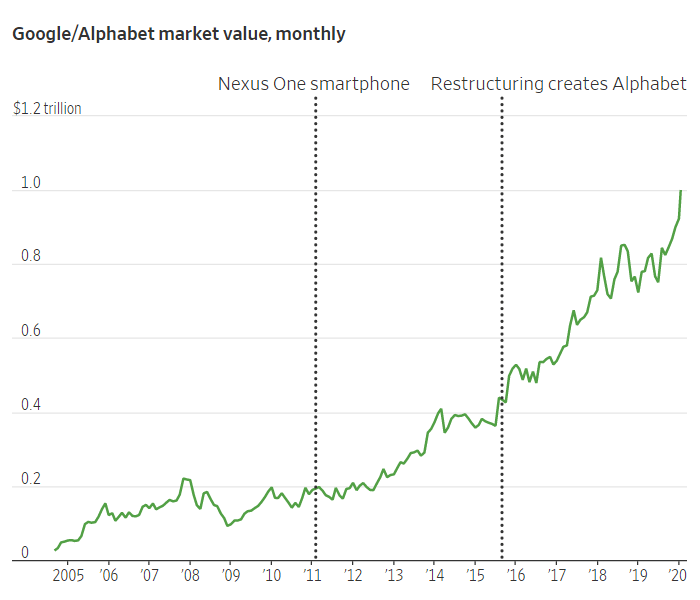

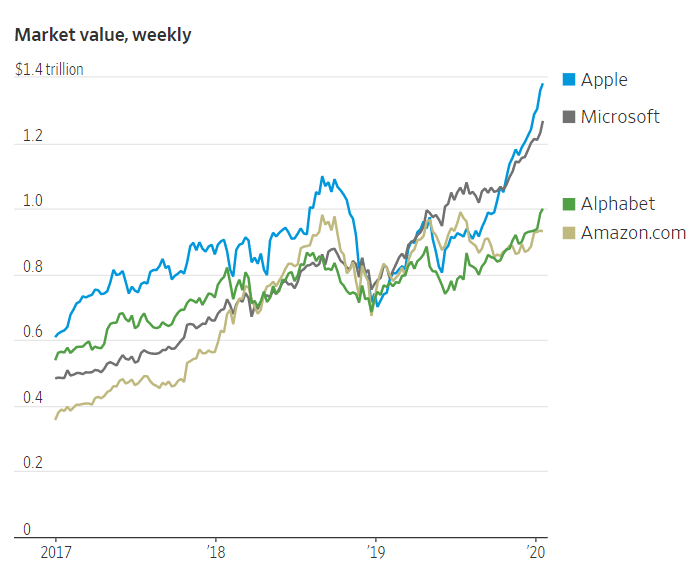

Google‘s parent company, Alphabet, finally attained a market value of more than $1 trillion. The holding company becomes the fourth company in the U.S. to reach this height, after Apple, Amazon, and Microsoft.

It hit the number just before markets closed on Thursday, ending the day’s trading at $1,451.70 per share, or up by 0.87% percent.

The company achieved this milestone just over a month after Google founders Larry Page and Sergey Brin stepped down from their respective CEO and President positions at Alphabet. The two founders trusted the tech giant to Sundar Pichai, by making him the CEO of both Google and Alphabet.

Pichai here controls everything of the two companies, which includes all the companies' core businesses - including search, advertising, YouTube and Android - and generates substantially all its revenue and profits.

But still, Pichai reports to Page, who also oversaw other businesses, making long-term bets on experimental technology like self-driving cars and package delivery drones.

What this means, while Pichai is in charge of the whole conglomerate companies, both Page and Brin still have control over most of the voting shares, giving them significant influence in major decisions.

The rise in Alphabet's market capitalization comes mostly from the company’s growth in its cloud business. While still far behind Amazon and Microsoft, Google's offering has doubled its revenue from $1 billion to $2 billion per quarter between February 2018 and July 2019.

Some analyst firms have also noted Google's profiting and stable advertising business.

While Alphabet's business is doing well, the company is facing a number of clashes and controversies, including the investigation by the U.S. National Labor Relations Board and various state and federal antitrust probes.

It has also been a bumpy road for the company, as it experienced allegations of sexual misconduct by executives, a 20,000-person Google Walkout employee protest, as well as the controversial Project Maven.

Despite concerns about stricter regulatory scrutiny, many big tech companies have continued soaring in value, highlighting how investors favor those firms that steadily improve sales.

The first company ever to hit a $1 trillion market cap was PetroChina in 2007, when it briefly reached that mark. And late in 2019, Saudi Arabia's Aramco became the first $2 trillion company shortly after its debut on the Riyadh stock exchange in December.

Apple and Amazon reached this height in the summer of 2018, while Microsoft hit $1 trillion for the first time in April 2019. Amazon never closed above $1 trillion and has fallen well behind Apple and Microsoft, which have rocketed past that level.

Despite concerns about stricter regulatory scrutiny, the biggest technology companies have continued soaring in value, highlighting how investors favor firms that steadily improve sales in a world with tepid economic growth and low interest rates.

Runner up is Facebook, which holds a valuation of roughly $620 billion valuation, with CNBC mentioned that the social giant could be next to join the elite club.

However, it should be noted that a trillion-dollar valuation doesn’t tell the complete story of the overall economic health of a company.

While the valuation is made, calculated and used to be the metrics to judge the performance of a company, the title is mostly for vanity purposes. But still, the trillion-dollar companies were still among the most-profitable companies in the world in 2019 according to Fortune.

In this instance, Forbes put Aramco at the top of its list, with Apple at second place, and Alphabet at seventh place.