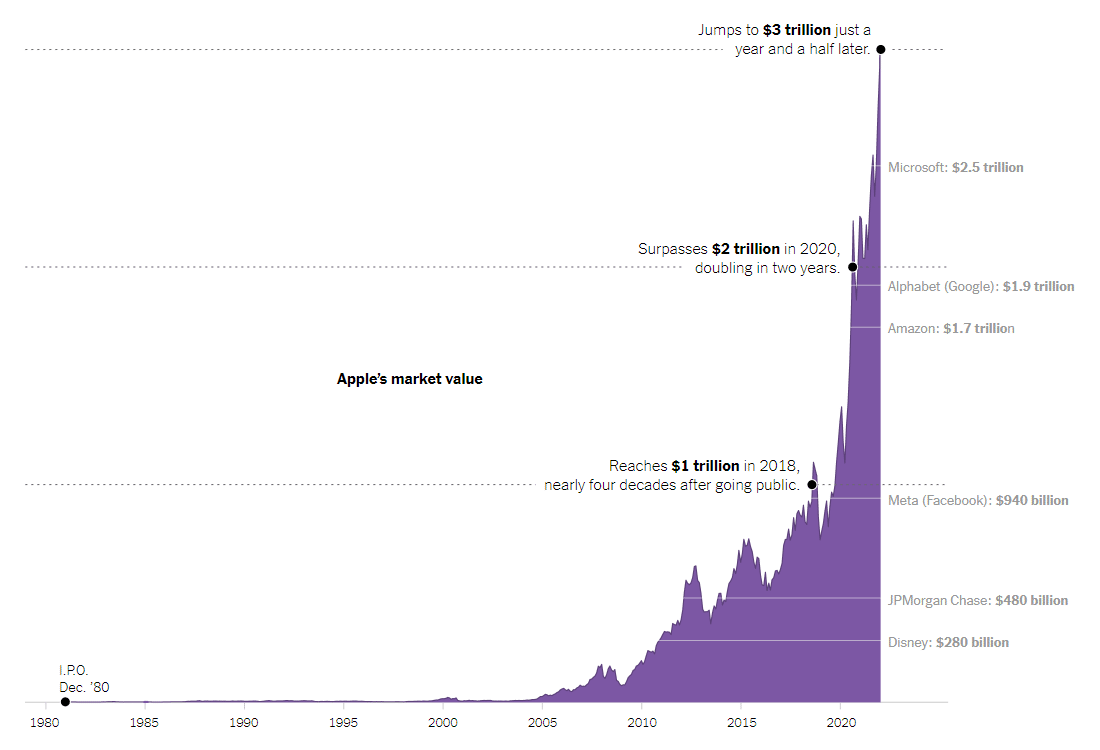

Apple, the iPhone maker, is reaching yet another huge milestone.

When Apple became a $1 trillion company back in 2018, the company was still way behind Saudi's oil company Aramco.

But when Apple surpassed $1.5 trillion market capitalization, things started to change.

This is because it didn't take long for Apple to finally surpassed Aramco, and became the largest publicly-traded company in the world, to then became the first $2 trillion dollar American company.

Two years later, in 2022, it's reported that Apple crossed the $3 trillion market capitalization.

Summarizing the milestones, Apple managed to go from zero to three trillion in a little more than two decades.

The milestone was reached when Apple shares were up surpassing the $182.85 per share it needed to be worth $3 trillion.

To put $3 trillion in another perspective, Apple's capitalization is larger than Walmart, Disney, Netflix, Nike, Exxon Mobil, Coca-Cola, Comcast, Morgan Stanley, McDonald’s, AT&T, Goldman Sachs, Boeing, IBM and Ford, combined.

Apple is worth more than the value of all of the world’s existing cryptocurrencies, and roughly equal to the gross domestic product of Britain or India.

Apple is also the equivalent of about six JPMorgan Chases, the biggest bank in the U.S., or 30 General Electrics.

With the achievement, Apple accounts for nearly 7% of the total value of the S&P 500, breaking IBM’s record of 6.4% in 1984.

Apple alone is about 3.3% of the value of all global stock markets.

Apple’s value is even more remarkable considering how fast the company is gaining its pace.

Such valuation may be impossible if done a decade ago. But since COVID-19 and the pandemic that swept almost all parts of the world, people are relying more on technologies and gadgets, more than ever.

The company has benefited from the booming demand for its IPhone 13 lineup and other older models, as well as subscription services such as Apple Music, Apple TV+, iCloud and its popular App Store, and not to mention, the high anticipation of its mixed reality headset and the long-rumored Apple car.

Apple, the computer company that started in a California garage in 1976, was founded by the late Steve Jobs and Steve Wozniak.

"When we started, we thought it would be a successful company that would go forever. But you don’t really envision this,” said Wozniak, the engineer and the person who hand-built some of the earliest Apple devices. "At the time, the amount of memory that would hold one song cost $1 million."

Apple once struggled, so hard that it had to make a deal with Microsoft to save itself from bankruptcy. It was Microsoft's founder Bill Gates, a frenemy of Jobs, who agreed to invest $150 million in Apple, which included a five-year commitment from Microsoft to release Microsoft Office and Internet Explorer for Macintosh.

This gave Apple a little bit of room to breathe.

It was in 2007 that Apple unveiled the original iPhone.

At that time, Apple was "only" worth about $73 billion.

Fifteen years later, iPhones have helped shaped the history of mobile, and became some of the most best-selling gadgets, ever.

With Apple earning huge margins by selling the iPhones, the company continues posting impressive growth.

In September 2021, iPhone sales were $192 billion, or up by almost 40% from the year prior.

And this time, as the iPhone maker’s value has tripled since 2018, the company also stockpiles cash big enough to buy a company like UPS, Starbucks or Morgan Stanley, straightaway.

Crediting CEO Tim Cook's strategy, this is because Apple does not make major acquisitions, or do anything ambitious or expensive. Instead, Apple has decided to largely give its cash back to its investors by buying its own stock.

Over the past decade alone, Apple has purchased $488 billion of its own shares, which is huge if compared to everything else.

Apple does the buybacks to reduce the number of total shares available for purchase, making each remaining share become more valuable.

This in turn encourages investors to buy, and then causing enough momentum in the stock market to lure more investors to cash in on the increase.

The huge gains sent investors fleeing to the safety of Apple stock, seeing that the company remains stable despite the uncertainty of the global economy.

Apple is capable of doing this by improving the underlying fundamentals of the company in equations that large investors and automated trading systems use to pick stocks.

The biggest gainer here would be billionaire investor Warren Buffett.

His big bet on Apple has paid off in a major way, making more than $120 billion on paper as the tech giant reached the $3 trillion market valuation milestone.

Buffet's conglomerate holding company Berkshire Hathaway started purchasing Apple stock back in 2016, and by mid-2018, the company had amassed 5% of Apple, through a stake that was worth $36 billion. In 2022, that Apple investment is worth a staggering $160 billion. Through its investments, Berkshire has received regular payouts averaging $775 million per year.

In return for making investors happy, Apple is able to make its stock price climbs even higher, and make its market capitalization to also increase.